Asia Weekly PET Overview (Week 14, dated 4 - 7 April 2017)

Asia Weekly PET Overview (Week 14, dated 4 - 7 April 2017)

Chinese suppliers lifted export offers; demand remains weak across region

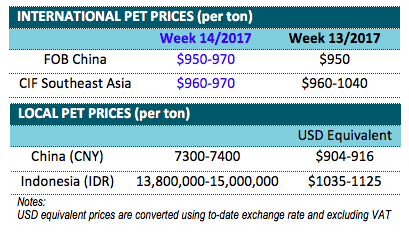

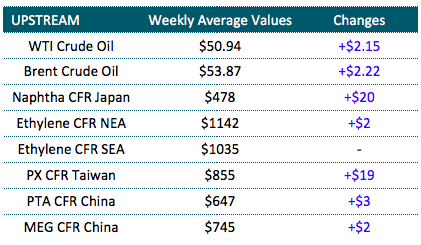

In Asia, purchasing activities remained sluggish this week though buyers seems to be more alert toward the end of the week as energy market regain momentum. Couple of Chinese suppliers decided to implement moderate hike on their export offers to reflect stabilizing upstream costs and expected better market outlook in the near term.

In fact, a Chinese PET maker opened new offers at $985/ton CIF Indonesia, LC AS term, a $15/ton hike week on week basis, however buyers are not responding to the latest import prices positively for the fact that local market continues to move lower. Domestic producer slashed prices this week as much as IDR200,000/ton ($15/ton) with a source close to the maker commented, “Buyers are placing bid at IDR500,000 ($38/ton) lower than initial offers, however we are unable to meet this price idea at the moment. Stock in local market is piling up and if demand does not pick up in the near term, we might have to adjust operation rate to reduce inventory pressure.”

Import materials therefore have lost its competitiveness over local cargoes. “We think international suppliers might face strong resistance and all effort to increased prices at the moment might yield limited returns. We prefer to source local material for now,” an Indonesian buyer said.

Vietnamese buyers are complaining about persistent weak end product business, especially small to medium size manufacturer. A converter said, “We have not been able to increase end products prices throughout the first quarter of this year and any hike in raw material costs could hit directly into our margins. We wouldn’t be able to accept any surge in prices at the moment.”

Meanwhile, in China, market sees limited transaction as players here were away for the Tomb Sweeping Festival during first half of the week. It is reported that domestic offers slipped another CNY50-100/ton ($7-14/ton) from last week, though suppliers are hoping to see better buying interest in the coming week. A trader commented, “We noticed that many of our regular customers have returned to check on latest offers toward the end of the week amid stronger energy market. If the upstream value hold firm in the coming week, very likely that buyers would make basic replenishment to avoid price risk. For now, demand in Japan is rather healthy despite the on-going anti-dumping investigation.”

Other Chinese producers have also confirmed the satisfactory buying interest from Japanese customers, in addition to the preparation for Ramadan season; couple of suppliers is planning to lift their offers in the coming week. A producer commented, “Some have already tested market respond to higher prices this week and seem Southeast Asian buyers are not ready to accept the new levels. We might monitor further development before lifting our offers.”

In related plant status news, Hainan Yisheng Petrochemical is planning to bring the first phase of the new PET plant with capacity of 250,000 tons/year on stream by end of April. Meanwhile, Jiangyin Chengxin Industrial Group would start up the second phase of the new PET plant with capacity of 600,000 tons/year within second quarter this year. Market might see additional supply to come and pressure might build up if demand does not pick up.