Asia Weekly PVC Overview (Week 15, dated 10 - 14 April 2017)

Asia Weekly PVC Overview (Week 15, dated 10 - 14 April 2017)

New offers awaited, players expect large reduction to India

In Asia, most players are waiting for major international suppliers to announce May shipment offers. However, a good portion of market has expressed expectation for lower prices mid persistent weak buying interest across the region. To make the pressure become stronger, Chinese suppliers slashed their prices to Southeast Asia just before the new price announcement.

Discussed with players in India, it is reported that demand in local ground show little improvement and buyers in the country strongly belief that May offers from international suppliers might drop significantly. Local producer in India recently slashed prices by INR3000/ton ($46/ton) bringing domestic prices to $965/ton EXW India, excluding VAT and excise tax, cash term. An Indian trader commented, “International suppliers would have to match the reduction in order to conclude deals. We have yet to see any improvement in term of demand while cash-flow issues would still be the main hurdle at the moment.” Several have called for at least $70-80/ton drop from last month at $930-940/ton CIF India, LC AS term with a market source added, “Anything higher than this levels would gain no support from buyers and shall fail like in previous month.”

Pessimism built up even with the up-coming labor trike at major ports in India, including Nhava Sheva, Mundra, Chennai, Vishakhapatnam, Tuticorin and Kolkata. As a result, the upload and unload work at these ports might be affected, causing delay in both export and import shipment. The extent of the impact is very much depended on the length of the strike.

There is also limited transaction reported in local China this week and another wave of environmental compliance inspection in Northern China area is keeping many unqualified converter off-line, dampening demand at the time that normally would be the peak season. Domestic offers for both carbide based and ethylene based PVC softened by additional CNY100/ton (14/ton) week on week basis. “We are not feeling confident about May outlook. Currently we are monitoring further development in the international market before deciding on our offers.” Couple of other suppliers has initiated price cut to export market in view of less optimistic outlook ahead.

Vietnamese buyers reported receiving fresh offers from a major Chinese ethylene PVC producer with $30/ton reduction week on week basis to reach $850/ton CIF Vietnam, LC AS term. Despite the reduction, buyers in the country appear to be lacking of confidence in making fresh replenishment. A trader in Northern Vietnam commented, “Carbide based PVC prices below the $800/ton threshold are still available at the moment. Domestic prices has softened considerably from last month though it normally high demand season in Northern areas at this time of the year. We are still having some Japanese cargoes on hand and prefer to deplete inventory before making fresh purchases.”

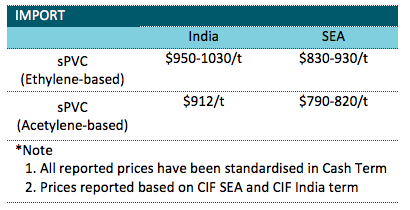

A summary of import PVC prices to the region is shown in the following table: