Asia Weekly PVC Overview (Week 23, dated 5 - 9 June 2017)

Asia Weekly PVC Overview (Week 23, dated 5 - 9 June 2017)

Market is stable; players await fresh offers from international suppliers

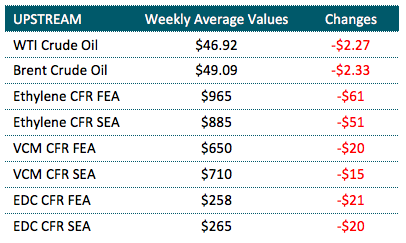

In Asia, import market remains largely stable from last week though transaction across the region is rather limited ahead of new offers announcement from major international suppliers. There are discussions that July prices might firm up though many buyers prefer to take cautious stance. Suppliers seem to be attempting to withhold any price decision amid Qatar crisis, which might affect VCM shipment out from the country.

Qatar Vinyl Company (QVC) produces 300,000 tons/year of VCM, 210,000 tons/year of EDC and 360,000 tons/year of caustic soda. With no downstream units, the company sells all of its output. QVC is in mid of full integration process with Qapco and is expected to complete by end of the year.

There are no major changes in term of prices and demand within India and market is waiting for fresh offers from major Taiwanese producer. Despite some rumors about possible $10-20/ton increase for the new month, Indian players are generally neutral about any hike at the moment. A market source said, “Overseas sellers might be looking at restocking activities after the Eid-ul-Fitr in July to support the firmer trend. However, with the current upstream market situation, there is not any strong push for firmer trend.” Indian sources also reported a retreat in demand for spot cargoes as the GST issue prevails the general sentiment and expected the start of monsoon in July.

Meanwhile, Chinese market continues to witness a reduction of CNY100-200/ton ($($15-29/ton) for both carbide based and ethylene based PVC, despite tightening domestic supply due to production restriction. As reported in the earlier week, Tianjin Dagu Chemical Co Ltd was forced to cut operation rate to below 50% on environmental restriction. The plant might need to run at low rate for about 20 days affected supply for ethylene based PVC. A trader said, “Yet, we are seeing a rather balanced condition as many converters are also shutdown due to environmental issues. It supposed to be the traditional high demand season now, but market seems so weak.”

The Southeast Asia market sees little movement with Chinese carbide based PVC opened at $780/ton CIF Malaysia, LC AS term. It is reported that the supplier is willing to offer $5/ton discount on deals, yet buyers finds it not attractive enough. A profile maker said, “We are still considering since demand for our end product is not strong this month.”

In Indonesia, major local producer rollover prices for June delivery at $910-970/ton, excluding VAT, FD Indonesia, cash term amid weak demand condition. “We are not having inventories pressure as out plant just restarted from longer than planned maintenance shutdown,” a producer source said.

In related plant news, Indonesia’s Asahimas has restarted its no. 3 VCM unit with 400,000 tons/year over last weekend, after a mechanical issues cause a delay from initial schedule. India’s Reliance is also planning to bring its 315,000 tons/year PVC plant on stream on 14 June after shutting it on 24 may for maintenance.

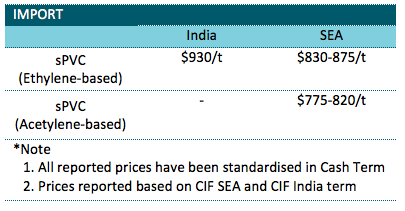

A summary of import PVC prices to the region is shown in the following table: