Asia Weekly PVC Overview (Week 29, dated 17 - 21 July 2017)

Asia Weekly PVC Overview (Week 29, dated 17 - 21 July 2017)

China remains the spearhead of firming trend, tightening supply might support further hike

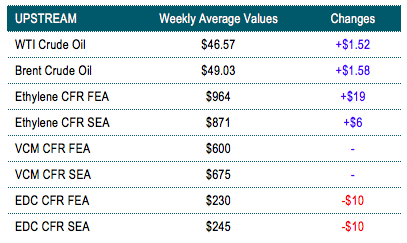

In Asia, after a major Taiwanese producer reportedly sold out August shipment allocation in the previous week, several other regional makers have also implemented similar hike. Demand in Southeast Asia and India is rather sluggish due to monsoon season, yet unexpected up-tick buying interest in China caught great attention.

In fact, local PVC prices in China extended another week of gaining, adding CNY100/ton ($15/ton) for carbide based PVC and CNY200-250/ton ($30-37/ton) for ethylene based PVC. For the first time in many weeks, domestic offers for ethylene based PVC hit above the CNY7000/ton threshold, reaching CNY7100-7200/ton ($896-909/ton without VAT), EXW China, cash term. A trader claimed to have sold a good quantity to local buyers at the new levels said, “Our allocation for August is soon to sold out. Demand come back sooner than expected and in the near term, we might only focus on local ground since export market does not offer as good margins.”

A carbide based producer added, “Sales have been very smooth this one month and we think this condition might persist in the near term. Our plant is not operating at high rate given the weather condition and reduced availability of carbide feedstock.” As a result, export market might hold stable to firmer in the coming months in spite of diminishing demand in India.

In fact, Malaysian buyers reported to have received fresh offers for Chinese carbide based PVC at $900-910/ton CIF, LC AS term as healthy local demand discourages Chinese sellers from seeking export businesses. Malaysian buyers are not very responsive to the new offers aware that market might continue to firm up in the coming month. A buyer said, “Most Southeast Asian suppliers are still maintaining offers in the range $850-870/ton for ethylene based PVC, and therefore we are not accepting anything above the $900/ton mark at the moment. Demand for our end product is soft and we have stock up sufficient material.”

And inspite of weak demand, thanks to stronger stance from Chinese suppliers, regional producer managed to achieve hike target for August shipment. A Thailand maker reported to have sold PVC cargoes to Southeast Asian buyers at $870-880/ton CIF, LC AS term said, “Yet, local demand in Thailand is rather disappointed. We hope firm import ground could exert some influence in the coming month.”

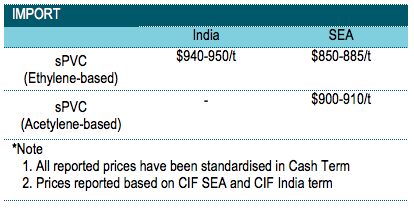

Meanwhile, there is limited movement observed in India as most buyers remain on the sideline to deal with the implementation of GST. In addition, players are not normally keep high inventory ahead of the monsoon season. A South Korean maker opened new offers at $940-950/ton, CIF India, LC AS term. A trader informed, “We are not seeing strong interest at the moment and we expect demand to continue deminishing in the near term. Suppliers might implement additional hike in the coming month with the support from China, and we prefer to be cautious.”

In related production news, Indonesia’s Asahimas Chemical took the No. 1 VCM unit off-stream this week for a month long maintenacne work. The unit is expected to restart by mid-August.

A summary of import PVC prices to the region is shown in the following table: