Asia Weekly PVC Overview (Week 33, dated 14 - 18 August 2017)

Asia Weekly PVC Overview (Week 33, dated 14 - 18 August 2017)

New offers emerged with large hike, SEA buyers show stiff resistance

In Asia, major Taiwanese producer announced September shipment offers with $60-70/ton increased from last month, bringing the latest prices to the highest levels since March this year. While Southeast Asian buyers continue to show resistance towards the new offers; Chinese and Indian customers have apparently accepted the hike.

Within Southeast Asia, several regional producers have implemented similar hike, following the trend pioneered by Taiwanese major. However, buyers are not supporting such drastic movement, especially those in pipe and profile sector as end product business remain sloppy. A Malaysian buyer received Thailand PVC offers at $920/ton CIF, said, “Our end product demand is not very strong as property market stall ahead of the general election. We are still having some stock on hand, therefore might skip purchases this time.”

Meanwhile, Vietnamese customers reportedly obtained USA material at $870/ton LC 180 days and Japanese PVC at $910/ton, LC 120 days, CIF term. These competitive cargoes are pressurizing the general sentiment in Vietnam, from which there are market rumors that major Fareast Asian suppliers have down-adjusted September shipment offers to below $900/ton threshold. However, this is not confirmed at the time this report is published.

In India, buyers have accepted the latest increment from Taiwanese major though sales remain relatively slow, which is due to the available of attractive local cargoes. “We have sold 50 per cent of Taiwanese cargoes at only small discount. Market would become more active if domestic producer follow the firming trend in the international ground. Therefore, we prefer not to cut our offers at the moment,” a distributor reported.

Indian buyers are also expecting higher prices from Iranian and Saudi Arabia suppliers, which were traded at very attractive levels in the previous month. “The sentiment is still weak and might fall further in the coming month due to Diwali holidays and the start of the monsoon season. We are very cautious about making replenishment at this time,” another Indian trader added.

Domestic China market is showing signs of stabilizing with new futures contract traded at soft levels throughout the week. This has shied away arbitrage traders, leaving highly resisted converters in the market. “Purchasing activities are still there, just that the momentum is slower now. We think market is nearing the peak, though possibility of a down trend remains limited with the support from tight availability,” a local trader said.

In related Plant Status news, Taiwan VCM is planning a month long maintenance shutdown starting next week, 21 August at its 420,000 tons/year VCM unit. Meanwhile, Japan's Tosoh will take its 600,000 tons/year VCM line in Nanyo off-stream on 3 September for maintenance. The plant is expected to come back online during mid-October.

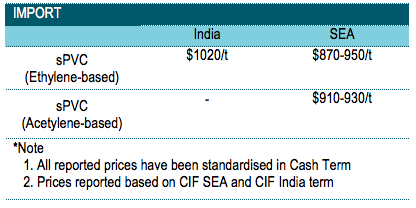

A summary of import PVC prices to the region is shown in the following table: