Asia Weekly PVC Overview (Week 36, dated 4 - 8 September 2017)

Asia Weekly PVC Overview (Week 36, dated 4 - 8 September 2017)

October offers emerged in India with increases, China demands turning weak

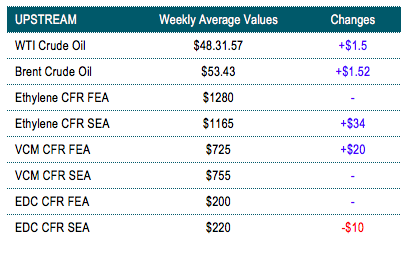

In Asia, major Taiwanese producer announced fresh offers for October shipment to India with increases month on month while other markets are still on the wait and see position. Tight supply remains the primary factor pushing the market, yet regional buyers are not responding very positively toward the latest hike.

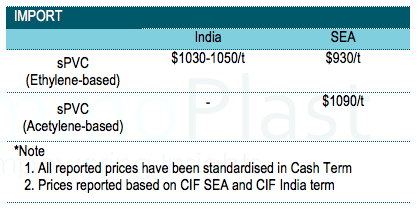

In fact, Indian players reportedly received new offers from a major Taiwanese maker with $60/ton hike from last month, reaching $1050/ton CIF, LC AS term. Demand for PVC in India remains relatively weak and sentiment sees little movement despite the recent shutdown at USA’s Formosa Plastic Corp and Oxy Vinyl due to Harvey tropical cyclone. A trader informed, “There is no buying interest for such high prices, but this move sets the tone for the general sentiment in October.” The source added that Iranian PVC is still available at $930/ton CIF India, LC AS term.

Another distributor added, “Buyers are not responding to the latest offers and we think it is hard for the maker to achieve full hike this time too. Demand is not strong and unless local producers adjust offers up, buyers would only source need cargoes domestically.”

Meanwhile in China, after a brief stabilization observed over the past two weeks, domestic producers in China continue to lift PVC prices claiming worsened supply crunch condition. Latest offers for both ethylene and carbide based PVC showed CNY300-400/ton increased week on week. Market resistance is building high as converters are facing tough time transferring the costs to end products, leading to a general slow down in purchasing activities. In contrast, sellers show no intention to decelerate the current firming trend. An ethylene based PVC maker commented, “Our current offer level in local China is as high as CNY8200/ton ($1072/ton excluding VAT), EXW basis, though there are resistances from buyers, we are still holding firm stance on our offers due to low inventory pressure at the moment.” Another trader added, "The thing is we only can sell small quantity these few days and demand might become frail again if additional price hikes are introduced in the near term."

Demand in Southeast Asia still the weakest among the regional markets. Vietnamese buyers are switching to source material from domestic ground at VND21,600,000/ton ($950/ton) excluding VAT, FD Vietnam, cash term, which is more competitive than import cargoes at the moment. A trader received offers for Chinese carbide based PVC at $1090/ton CIF Vietnam, LC AS term said, “Taking into account the 5 per cent import duties, we are unable to compete with local suppliers in any sense. We have purchased 300 tons from domestic producers, and temporary planning for no import.”

In related Plant Status news, China’s Tianjin Dagu is operating its 800,000 tons/year PVC unit at low rate due to strict environmental regulation. Meanwhile, Japan's Taiyo is conducting an annual turnaround at its 90,000 tons/year PVC unit. The line might only resume operation by end of this month.

A summary of import PVC prices to the region is shown in the following table: