Asia Weekly PVC Overview (Week 37, dated 11 - 15 September 2017)

Asia Weekly PVC Overview (Week 37, dated 11 - 15 September 2017)

Demand in India expected to pick up, Asian buyers await October shipment offers

In Asia, there are very limited transaction reported across the region despite the availability of new offers from a major Taiwanese producer in India. The general sentiment remains sluggish though players are expecting a pick up in demand in India soon. Meanwhile, Asian players are awaiting new offers from overseas makers with smaller hike compared to India market.

In India, latest import PVC offers from a Taiwanese producer with $60/ton increased month on month, reaching $1050/ton CIF, LC AS term, faced serious resistance. Traders were hoping that a large hike from a major domestic producer would encourage buyers to come back to import ground. Unfortunately, local marker announced new offers at only INR1000/ton ($16/ton) higher, defending the competitive position of domestic cargoes. “We think there must be another upward adjustment for local material in the near term. At the meantime, import offers nearing the $1050/ton mark might not attract satisfactory sales,” a trader inform. The smaller than expected increment in local cargoes created a question on whether overseas suppliers be able to achieve the full hike target this month.

Meanwhile, it is also reported that a number of lower costs Iranian cargoes are facing serious delay and some even have to be cancelled as producers here are unable to operate at normal rate due to lack of ethylene. Buyers shall need to source alternative cargoes to ensure stock levels and it seems at the moment, local cargoes would be the next best choice, source said.

There are limited movement reported in Southeast Asia market and players are generally waiting for fresh offers from overseas sellers. However, market participants are not seeing a $60/ton hike as it was introduced in India in the previous week. In contrast, most are expecting a $30/ton increase month on month. “Prices above the $1000/ton mark based on CIF term might not in favour of buyers. This is because most domestic markets within the region are still selling at lower levels due to mediocre demand condition,” a regional producer commented.

Within Indonesia, major producers maintain offers unchanged in the range $970-1000/ton FD Indonesia, cash term, excluding VAT. “We are not able to transfer higher raw material cost to end product prices, and therefore, would there be a large increment for October, we might have to slower our purchasing activities,” a converter said.

In China, falling futures market is affecting buyers confidence in the near term outlook. According to CommoPlast data, spot PVC prices in China are currently higher than futures market by CNY300-400/ton ($46-61/ton), attracting arbitrage traders to channel materials to spot ground, causing a drop of CNY200/ton (31/ton) week on week for carbide based PVC and CNY100/ton (15/ton) for ethylene based PVC.

A trader informed, “However, most local producers are still facing restriction in run rate, hence supply is not very pressure. We expect to see another round of replenishment before entering the National Day holiday.”

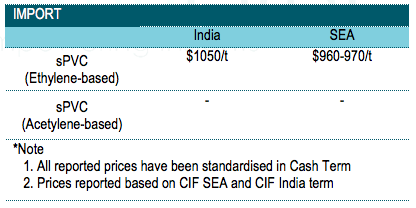

A summary of import PVC prices to the region is shown in the following table: