Asia Weekly PVC Overview (Week 16, dated 16 - 20 April 2018)

Asia Weekly PVC Overview (Week 16, dated 16 - 20 April 2018)

Taiwanese major slashed May shipment offers, demand in India showed signs of picking up

In Asia, a major Taiwanese producer announced May shipment offers with $50-60/ton reduction from last month in spite of stronger upstream costs. The cuts come in line with players’ expectation due to an unexpected slow down in major importer – India in the previous month. However, sources are looking at firmer trend in the coming weeks as demand across the region started to improve.

Purchasing interest in India improved visibly this month as buyers rushed to make replenishment after the ban on the issuance on Letters of Undertaking (LoU) hampered cargoes off-take rate in the previous month. “Taiwanese producer sold out approximate 25,000 tons of allocation to India very quickly after the price announcement. Other producers also manage to deplete quantity easily to India this time,” a trade said. Deals for Taiwanese, South Korean and Japanese PVC are reported at $970-980/ton CIF India, LC AS term.

However, the large reduction in the import ground is likely to affect the domestic market, sources said with a trader added, “A new discount scheme would emerge in the coming week, and depending on the scale, it might have reciprocal impact on import materials, especially those with high anti-dumping duties that wish to divert cargoes to India this month.”

Meanwhile, trading activities in Southeast Asia are rather mediocre and the latest price cuts chilled the sentiment even further. “Competitive Chinese and USA materials have been dominating the market over the past weeks and with the latest price cut from the major Taiwanese maker, buyers are just becoming more cautious,” a Vietnamese trader purchased USA PVC at $875/ton CIF, LC AS term said.

Malaysian buyers also reported purchasing Chinese carbide based PVC at below the $900/ton threshold, which encouraged market to put hard-negotiation on other cargoes. “We have comfortable supply until end of May and in no rush to make new purchases in the near term. Demand for pipe and profiles in Malaysia is weak as customers refrain from keeping high inventories amid uncertainties associated with the general election,” a PVC pipe manufacturer, who bought Chinese carbide based PVC at $880/ton CIF Malaysia said.

In China, demand has not shown any real improvement and bloated inventories levels continue causing dull sentiment. Spot offers for both carbide and ethylene based PVC fell CNY50-100/ton ($8-16/ton) from last week, yet players hold positive expectation for May. “It is the traditional high demand season and buyer shall come back to replenish cargoes soon. We believed market is nearing the bottom and firmer trend would emerge in the coming month,” a trader said.

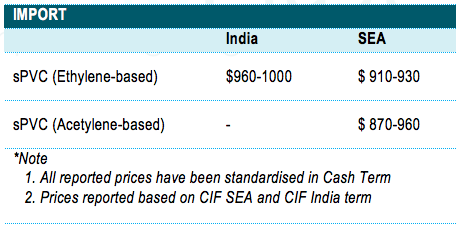

A summary of import PVC prices to the region is shown in the following table: