Asia Weekly PVC Overview (Week 19, dated 7 - 11 May 2018)

Asia Weekly PVC Overview (Week 19, dated 7 - 11 May 2018)

Market eagerly await new offers with expectation for stable to firmer trend

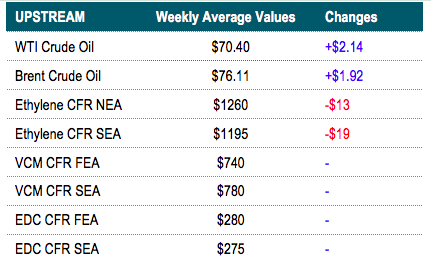

In Asia, regional players are awaiting fresh PVC offers for June shipment from a major Taiwanese producer with most expectation calling for a stable to firmer trend. The positive outlook derived from the smooth sales results to India in the previous month combined with strong local market in China in the recent week.

There are no major movements in India throughout the week and there has been reports that total import PVC booking for May shipment reached approximate 135,000 tons. “This number is slightly higher than usual while market started entering the monsoon season, and therefore, we remain uncertain if June shipment offers could move higher,” a trader informed.

In contrast, domestic China market witness the strongest hike in months as players here bet heavily on the bull market in the near term considering the government effort to revamp the country piping system while supply might tighten due to heavy turnaround. Carbide based PVC rose CNY200-400/ton ($31-63/ton)from last week to CNY7050-7250/ton ($954-981/ton without VAT), while ethylene-based PVC jumped CNY300/ton ($47/ton) to CNY7400/ton ($1001/ton without VAT), all based on EXW China, cash equivalent.

The market started showing stiff resistance after the latest prices adjustment, however, there is no indication from supplier side regarding potential step back. “It becomes more difficult to attract deals at prices above the CNY7000/ton ($948/ton without VAT) threshold for carbide-based PVC, however, production costs are high due to the stringent environmental regulation and therefore, our customers only procure materials hand to mouth basis,” a carbide-based producer informed. The constant firming trend in local ground might discourage Chinese suppliers from exporting cargoes, instead, focus more on domestic need.

Southeast Asian market is rather calm with Malaysian buyers are away for most of the week due to the general election. Meanwhile, a major Indonesian producer said, “We are still clearing backlog at the moment, therefore, not having much spot cargoes. Demand in Indonesia is acceptable at the moment, yet, might subside in the near term due to the Lebaran season.” The source shared an opposite view regarding the possible price trend in June citing that fasting month in Muslin markets and the monsoon season in India would encourage some price cuts from international suppliers.

In related plant news, Taiwan Formosa Plastics Corporation is planning a brief maintenance shutdown at its 500,000 tons/year PVC unit in Mailiao during the final week of June 2018. The plant is expected to remain off-line for 7 days.

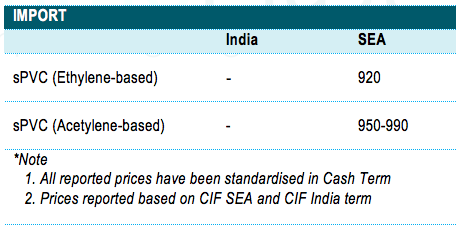

A summary of import PVC prices to the region is shown in the following table: