Asia Weekly PVC Report (Week 16, 11-15 Apr 2016)

Asia Weekly PVC Report (Week 16, 11-15 Apr 2016)

Firmer prices amid slower sentiment

In Asia, the PVC market continues to move up with a major Taiwanese announced May shipment offers with $30/t higher than last month for all markets, reflecting supply tightness, strong upstream values and relatively good demand in Indian buyers.

In India, players are reporting an apparent weaker buying interest this month with a trader explained, “There are large quantity of material arriving the main port easing local supply while the monsoon season might start in June. This has discouraged many traders from in-taking any cargoes this round.” Yet, major Taiwanese maker managed to sell out their regular allocation of 30,000 metric tons to this market without any discount, just slightly later than the initial validity date.

In China, sentiment has not seen any significant improvement and falling futures prices are casting further pressure on the prices. Local traders slashed CNY50/t ($8/t) on domestic offers to stimulate demand yet many have expressed their disappointment. A seller commented, “We were expecting some replenishment activities this week since buyer’s inventories are rather. However, we did not receive sufficient number of buying enquiries. Most of our regular buyers are complaining about slow end product demand, hence they only purchase to meet immediate need.”

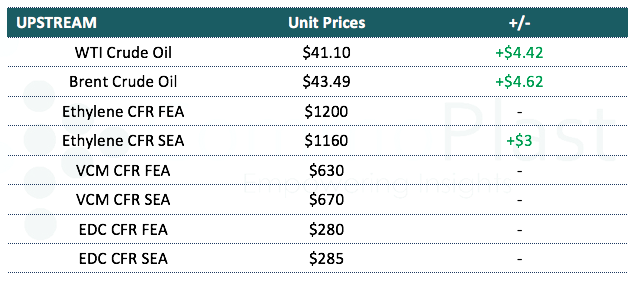

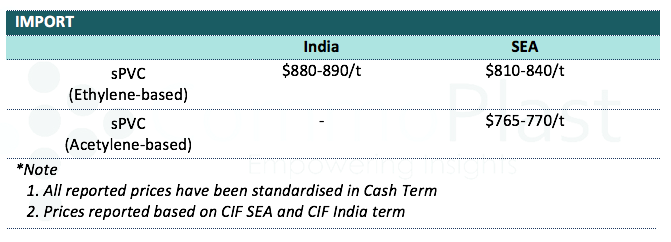

A summary of import PVC prices to the region is shown in the following table:

In Southeast Asia, the market acceptance towards the fresh hike for May shipment is not very strong while widening gaps between carbide based and ethylene based PVC prices are also giving buyers more rooms to compare when it come to making purchases. A Vietnamese buyer commented, “We was surprised that our Japanese supplier is very open to negotiation this time, unlike the firm stance they held last month and this has sparked some indication to us. Demand for our end product is regular at the moment.” Players are now very cautious as the monsoon season and the fasting month is just around the corner.

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.