Weekly PVC Overview - Week 38 - 2018

Weekly PVC Overview - Week 38 - 2018

Week 38, dated 24 - 27 September 2018

In Asia, following the steep price cuts for October shipment from major overseas producers, buyers in China and Southeast Asia seems to have stronger buying interest. Regional buyers perceived the current market prices as nearing the bottom and tend to make larger replenishment, raising hope that the market would be brighter next month.

In fact, Chinese buyers aggressively replenish cargoes this week, partially to prepare for the weeklong National Day Holiday from 1 to 7 October. There has been report that the major Taiwanese maker sold approximately 30,000 tons of allocation to China this month at the level $850-860/ton CFR, LC AS term – nearly three-fold of the usual quantity. “The $100/ton reduction is large. Export-oriented converters are happy with the price cuts and decided to take larger quantity to replace the missing USA material,” a market source said.

Domestic spot market sees CNY50-100/ton ($8-16/ton) reduction week on week, much smaller than the imports. At the time this report is published, local offers stand at CNY6800-6850/ton ($853-860/ton without VAT) for carbide based and 7200-7300/ton ($903-916/ton without VAT).

A field survey based on selective sample (including several plants, warehouses, and converters) found that total inventories at producer’s warehouses reduced approximately 1.6% from last week, while trader warehouses and converters side down 40.58%.

A similar situation is observed in the Southeast Asia market, particularly in Malaysia and Singapore. A major Indonesian producer claimed sold out 4000 tons of allocations to these two markets at $850-870/ton CIF Malaysia and at $870-880/ton CIF Singapore. “Demand from local Indonesia market is healthy, too, especially from PVC sheet makers as end product buyers seek alternatives from high price PET sheet. We would soon announce local prices and the initial indication is that there might be some $60/ton cut,” a source close to the producer said.

A major Thailand producer also reported sold 2000 tons of PVC to Malaysia this week, underlining the improved demand condition here. Southeast Asian market might start seeing better end product demand in the coming month as the monsoon season ease at some parts of the region.

Demand for imports in India remains sluggish this week, especially after a local producer announced price protection schemes, sources said. A number of other overseas suppliers have also expressed the intention to put more focus on China market due to the inability to deplete allocation in India. Couple of distributor in India have requested for additional quantity, however, the maker was unable to fulfill the inquiries. “We were informed that there is no more available quantity due to excellent sales result in China market,” a distributor said.

In related plant news, South Korea's Hanwha Chemical has shut its No. 1 and No. 2 VCM plants at Ulsan on 16 October for scheduled maintenance. The two plants with a combined capacity of 250,000 tons would resume production on 7 November.

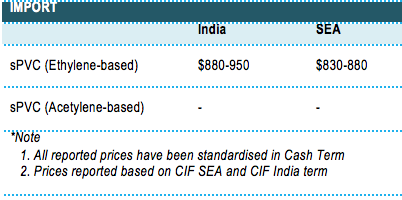

A summary of import PVC prices to the region is shown in the following table: