Weekly PVC Overview - Week 41 - 2018

Weekly PVC Overview - Week 41 - 2018

Expectation for November offers mixed. China market resumes trading on stable notes

Week 41, dated 8 - 12 October 2018

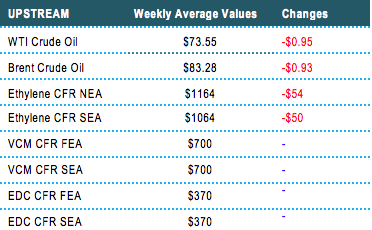

In Asia, suppliers have already concluded business for October shipment and market is waiting for major Taiwanese maker to announce new prices, likely on 16 October. The initial expectation on the potential price trend is rather mixed with China hold steady appetite for replenishment while exchange rate continues hurdling import business in India.

Until this week, players in this market continue seeing sluggish demand condition while the steep depreciation of the Indian Rupee is discouraging demand for imports. “Demand for rigid PVC pipe is poor. We expect to see at least $30/ton reduction in the new offers compared to last month,” an Indian buyer commented.

A major local producer maintains PVC prices unchanged this week while lifting PP, PE offers by INR1500/ton ($20/ton) citing the exchange rate issue. “We expect the local producer to only adjust PVC prices after new offers from overseas maker emerged. With the active price protection scheme, it is less likely that buyers would source more cargoes from the import market,” another trader said.

Meanwhile, Chinese buyers resume trading after the weeklong National Day holiday receiving a minor increase in local offers of CNY50/ton ($7/ton) for both carbide and ethylene-based cargoes. At the time this report is published, carbide-based PVC is traded in the range CNY6800-6850/ton ($850-856/ton without VAT) and ethylene-based PVC at CNY7200-7300/ton ($899-912/ton without VAT), all based on EXW China, cash equivalent.

“Sales remain smooth this week. We expected this condition to persist until mid or late November due to the traditional peak demand season. We are not having large allocation for export and therefore, we think new offers from overseas producers to China would follow the stable to slightly firmer from last month,” a local producer said.

In Southeast Asia, USA cargoes are still available at $830/ton CIF Vietnam, LC AS term. With the US dollar continue strengthening against other currencies, it becomes a challenge for suppliers of this origin to maintain competitiveness. “Duty-free cargoes from Thailand are not much different in term of prices and we could avoid the long lead time risk. We are now waiting for new prices to emerge,” a buyer said while adding that demand in local Vietnam market is not very strong at the moment.

In the meantime, Indonesian buyers are hoping to receive additional discount before procuring large buy for the high demand season. “Upstream ethylene costs are still falling and therefore, there is a high chance of lower PVC offers for November shipment,” a local trader added.

In related plant news, Japan’s Tosoh might take its 250,000 tons/year no. 1 VCM line in Nanyo off-stream for about 45 days starting 17 October.

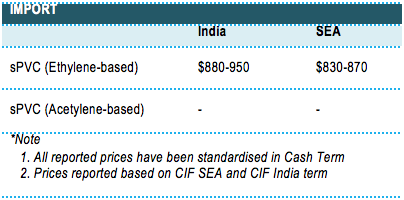

A summary of import PVC prices to the region is shown in the following table: