Weekly PVC Overview - Week 42 - 2018

Weekly PVC Overview - Week 42 - 2018

November shipment offers emerged at discount, India demand picks up significantly

Week 42, dated 15 - 19 October 2018

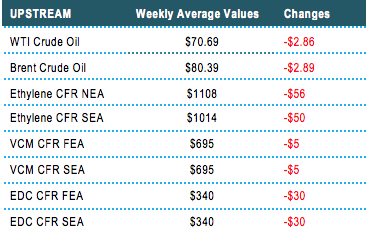

In Asia, a major Taiwanese surprised the market by offering $60/ton discount on November shipment offers to India and another $30/ton to Southeast Asia and China. Demand across the region improved visibly based on strong belief that market might be nearing the bottom.

In India, the Taiwanese producer managed to sell out all available allocation in less than two hours from the new price announcement time. The downtrend is much in-line with market expectation, however, the extent of the reduction amazed many buyers. “We did not expect such large price reduction. However, the market is responding very well to the new price list. We think the market has hit the bottom and likely to track the firmer trend in the coming month,” an Indian trader commented. There has been report that the producer sold more than 30,000 tons allocation to India this month.

Indian buyers are expecting a similar move from other international and local suppliers in the coming days and several have expressed the intention to make additional replenishment this time.

In Southeast Asia, regional producers found the latest price cuts unreasonable claiming that demand is not too negative to drag market to the multi-month low levels. In fact, producers from Thailand and Indonesian decided to maintain offers unchanged month-on-month at $860/ton CIF Southeast Asia, LC AS term.

“Depending on the market, we have sold some quantity at $840-860/ton with the same term. We expect purchasing activities to pick up in the coming week, in line with the widespread expectation that the market is nearing the bottom,” a Thailand maker informed.

Meanwhile, the strengthening US dollar is diminishing the competitiveness of this cargo in Southeast Asia. Suppliers for US material are facing tremendous difficulty in attracting deals this week following the additional price cut from the Taiwanese producer. “Asian cargoes are too competitive due to the shorter shipping time. It becomes more challenging for deep-seas cargoes such as US materials,” an international trader offers USA PVC at $830/ton CIF Vietnam, said.

Meanwhile, local China market continues facing the downtrend with offers for both carbide and ethylene-based PVC dropped CNY150/ton ($22/ton) and CNY100/ton ($14/ton) respectively from last week. “Demand is a little slow. Customers seem to have replenished comfortable inventories and prefer to not engage in any large deal at the moment,” a trader said.

It is expected that export allocation from Chinese suppliers might remain tight in the coming month as stringent environmental control during the winter time could limit the carbide supply, leading to lower operation rate among carbide-based PVC plant.

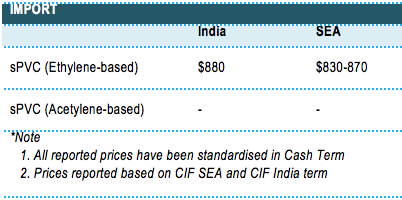

A summary of import PVC prices to the region is shown in the following table: