Asia Weekly PVC Report (Week 19, 02-06 May 2016)

Asia Weekly PVC Report (Week 19, 02-06 May 2016)

Regional buyers expect stable trend for June

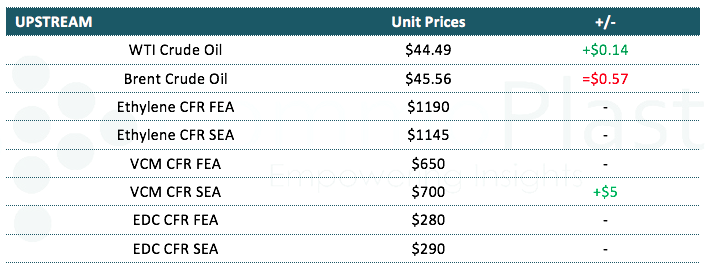

In Asia, the PVC market remains relatively stable on the first trading week of a new month as players are now waiting for major Taiwan producer to announce offers for June delivery. Many have brought up expectation of a stable to soft trend in the coming month given slower demand in India market.

In India, there were rumors regarding troubled unloading monomers cargoes at one of the major local plant. However, demand is reported to be rather stagnant and with the approaching monsoon season, traders are not that optimistic about the upcoming market prospect. A trader shared his opinion saying, “Demand is fading, however we think international sellers might attempt to maintain their offers unchanged from last month given several shutdowns at Fareast region. We are not seeing any supply issues domestically, and the impending monsoon season might dampen demand further.”

Buying interest in China market has not shown any sign of improvement, and indeed, falling futures market is fostering the sluggish sentiment. An ethylene based PVC producer cut offers by CNY50-100/ton ($8-16/ton) this week said, “Our customers are not active in making fresh purchases claiming slower than expected end product demand. International trading ground is also entering the traditional slow season; hence we are not confident about the near term outlook.” Meanwhile, carbide based PVC makers are keeping the idea of cutting prices at bay given high carbide costs.

Most market in Southeast Asia region has a very short trading day this week, taken into account a number of holidays. However, production glitches at major regional plants are now a pinching concern among buyers. A converter in Malaysia said, “Our Thai suppliers have encountered some technical issues at their plants recently, however, no details were announced. We think this might support the overall market amid falling demand.” Import carbide based PVC to the region is down adjusted by $10/t compared to last week, players reported.

As reported earlier, Korea’s Hanwha Chemical Co Ltd and Japan’s Shin-Etsu Chemical Co Ltd planned a month-long maintenance shutdown at their plant in May 2016. Both plants have annual capacity of 300,000 tons/year and 550,000 tons/year respectively.

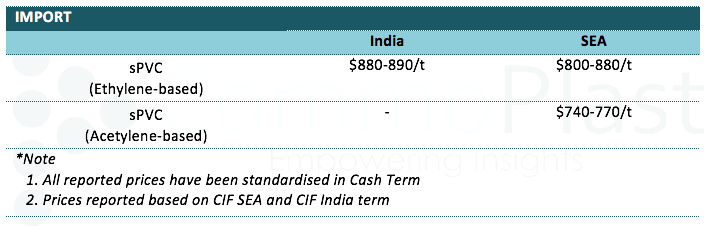

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.