Asia Weekly PVC Report (Week 21, 16-20 May 2016)

Asia Weekly PVC Report (Week 21, 16-20 May 2016)

Eroded demand rodents stable trend expectation

In Asia, market remained await new prices from major Taiwanese maker this week, however, demand across the region shows clearer signs of weakening as monsoon season started in some countries, from which many players changed their expectation from stable to slightly soften in the coming month.

In India, there is no further update on the restart schedule at Reliance’s plant after the company unexpectedly shutdown its 315,000 tons/year PVC unit in Dahej due to water shortage last week. Players commented on this issue seeing little impact on the domestic supply as import cargoes arrived balance with the dimishing domestic demand. A trader commented, “Buying interest is loosing steam as part of India enters the moonsoon season. Taiwanese major delay annoucing new prices for June delivery till next week, therefor we are on the wait and see stance now, however we are not confident that price can maintain the stable trend.”

In China, the annual Carbide based PVC producer Joint Assembly Conference take place this week and domestic offers firmed up CNY50/ton ($8/ton). However, demand has not seen any significant improvement. An ethylene based PVC producer said, “We are not expecting and drastic downward movement in the near term as supply in general is still not sufficient. From our side, we have yet to be able to normalize operation rate since the maintenance shutdown in early April, therefore this time we might only focus on the domestic market.” Carbide based producer continue to complain about high production costs as a result of tighter environmental control from government.

Southeast Asia market sees very little movement, as players are away from their desks for APIC in Singapore. Market, however, are not very optimistic about the near term outlook despite production issues in Thailand and Indonesia are limiting regional supply. Converters in Malaysia were informed by a Thai maker that there might not be any offers for June delivery due to persistent technical glitches at their plant. Another Vietnamese producer informed, “Domestic demand is weak, yet we are having large backlog need to clear this month. We hope market could sustain the stable trend, though outlook isn’t so optimistic to us.”

In the Plant Status news, Indonesia’s Asahimas announced expansion at its VCM unit, which would add another 100,000 tons/year to the existing line, lifting total production output to 900,000 tons/year by 2018. The output is expected to feed its own downstream PVC line and the excess quantity shall be dedicating to Phu My Plastics and Chemicals Co Ltd in Vietnam.

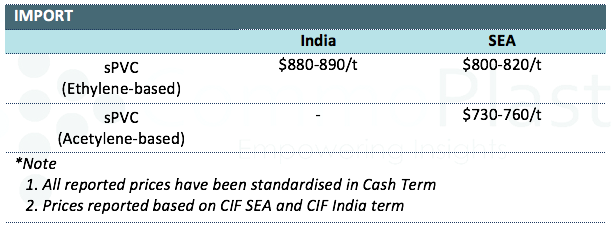

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.