Asia Weekly PVC Overview (Week 22, 23-27 May 2016)

Asia Weekly PVC Overview (Week 22, 23-27 May 2016)

Market softened on new prices from Taiwan major

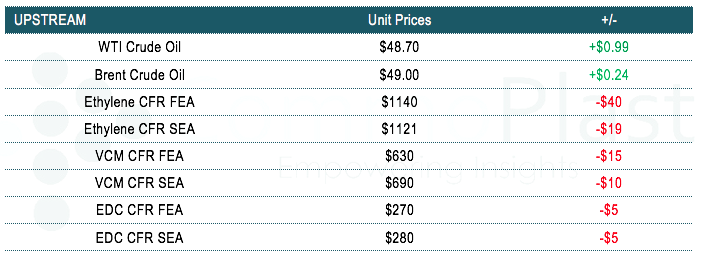

In Asia, market turned soft this week following new price announcement from a major Taiwanese producer, which indicated some $30/ton reduction from last month. Most other suppliers follow suit to open offers at similar levels. Demand on the other side is weakening as major regional markets enter the monsoon season.

It is also reported that Taiwanese major reduced export allocation by approximate 15% compared to previous month and managed to sell out 15,000 tons to India, 15,000 tons to China and another 20,000 tons to Southeast Asia and other market.

In India, buyers started to show certain level of reluctance in making fresh purchases given expectation of slower end product demand during raining season and comfortable domestic supply. A trader said, “Most of our customers are hoping to see lower prices in the coming month considering weakening upstream costs and absence of demand. For June delivery, the Taiwanese producer only has 50% regular allocation to India; therefore they can sell out quickly. Domestic producer this week has announced price protection, this might also deter buying interest for import cargoes.”

In China, buying interest is reported to be especially weak among major Asian markets despite tightened environmental control has forced domestic producers to cut operation rate. Domestic offers remain largely stable from last week with seller claimed lack of inventories pressure. A carbide based PVC maker commented, “We are looking for opportunity to export more cargoes to Southeast market given diminishing basic demand in domestic ground. Supply is not ample right now due to a series of regional plant shutdown, however, we believed that market might see increased inventories in line with slower regional demand.”

In the statistics news, data from the China Custom Department show import PVC to China in April 2016 dropped 15.7% month on month to reach 50,311 tons while PVC export from the country for the same period remain resilient at 136,988 tons, increased 10.9% from the month earlier.

Southeast Asia market is not very active as buyers withdraw to the sideline waiting for further reduction in the coming days. A regional producer cut offers by $30-40/ton to reach $800-810/ton CIF SEA. LC AS term said, “Demand is rather slow and we are facing stiff competition from Japanese and carbide based cargoes. Our plant is not operating smoothly, however, we are not optimistic about the near term outlook considering the impending fasting month and weakening upstream market.” Converters in Malaysia are also reporting visible drop is pipe and fitting product demand, which players blamed tightening bank credit control and strong US dollars.

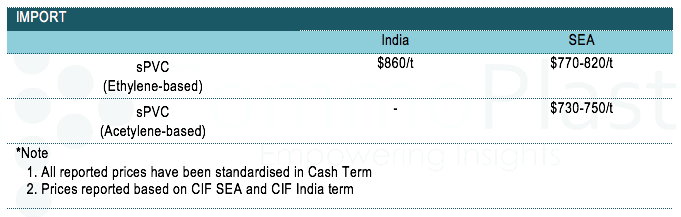

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.