Asia Weekly PVC Overview (Week 23, 30 May - 3 June 2016)

Asia Weekly PVC Overview (Week 23, 30 May - 3 June 2016)

June business settled amid softer sentiment

In Asia, most of June business has been settled, however, market sentiment is getting slower in line with the monsoon season in major regional markets. Import offers to the region started to show some weakness as sellers give discount to entice demand.

In India, demand is reportedly diminishing and the rainy season might dampen buying interest further in the coming month. Many players have expressed bearish expectation for July considering the current state of demand and falling upstream costs. A trader in the country said, “Basic demand in India market still exists, however the overall sentiment has slowed down visibly. This condition is expected to sustain until the monsoon is over in August – September period. Meanwhile, ethylene costs are eroding too quickly, this might result in another $20-30/ton reduction in the coming month.”

In China, demand has not shown much improvement though import business for June delivery has also completed. Players in the country are complaining about persistent weak demand in which sellers are forced to offer discounts to attract buying interest from the export market. A carbide based PVC producer offers their cargoes at $730/ton CIF Southeast Asia, LC AS term said, “We have not been able to achieve desirable sales in local ground despite general tight supply as a result of reduced operation rate at major PVC plants following tighter environmental control. We are looking for opportunity to export our cargoes to the nearby markets to enhance margins.” Players are sharing similar expectation about the near term outlook with lower demand in India.

Southeast Asia market remains quiet after buyers concluded required cargoes. Near term expectation among market players is not much of bullish as some countries enter traditional slow season. Sellers, including Japanese suppliers have closed deals below $800/ton threshold at $790/ton CIF Southeast Asia, LC AS term. A Thai maker meanwhile reported, “Demand in Thailand remain relatively healthy. Therefore, we plan to reduce prices no more than the reduction seen in import market recently. We are not having large cargoes in hand due to some previous plant issues, however, looking at the inertia export business, we are not confident about the market outlook in July.”

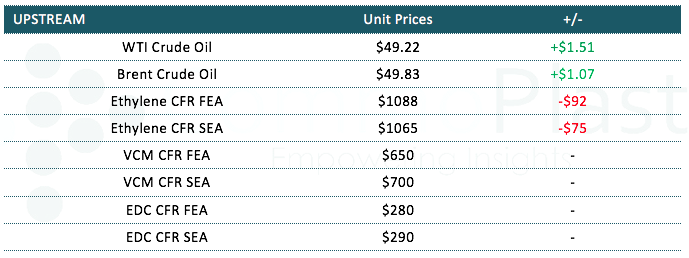

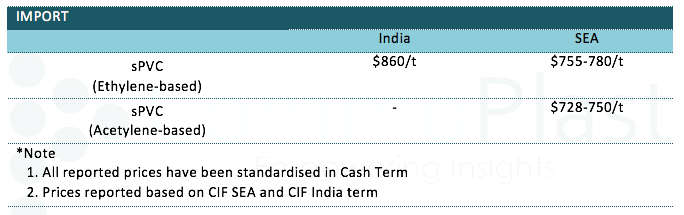

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.