Asia Weekly PVC Overview (Week 29, 11-15 July 2016)

Asia Weekly PVC Overview (Week 29, 11-15 July 2016)

Market moved north on new offers, demand remain robust in India

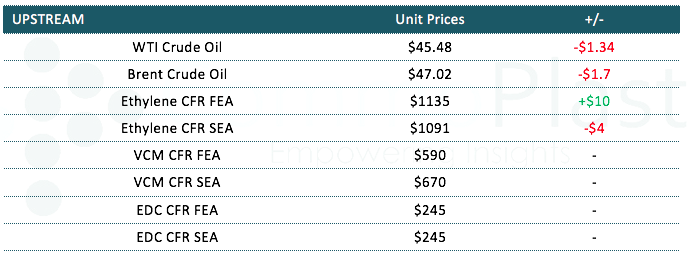

In Asia, the PVC market moved up visibly with a Taiwanese producer announced fresh offers for August delivery at $40/ton hike from last month. Healthy demand in India continues to lift the whole sentiment across the region, in addition to limited availability ahead of major shutdowns in Fareast, players mostly expecting further price increment in the near term.

In India, it is reported that regular Taiwanese maker only can supply 50% of regular allocation this month, resulted in a general tightness, which attract buying attention though the monsoon season remain in place. For this, the supplier reportedly sold out all available allocation to the country shortly after the new price announcement. A trader in the country said, “Buyers are still active in asking for additional quantity. One of our Korean suppliers might only announce new prices next week, however, we think they might aim to sell above the market benchmark. We think this is the market turning point and constraint supply would continue to support firmer trend in the near term.”

In China, player reported seeing improved trading condition on the back of tightened supply and firming international trend. Domestic suppliers therefore lifted offers by CNY50-100/ton ($7-15/ton) compared to last week to reflex the current market condition. An ethylene based PVC producer in Ningbo said, “Supply for this grade is shorter than others given several major plants have been operating at lower rate for an extended period of time. For this we lifted our prices by CNY100/ton ($15/ton) for domestic buyers and $40/ton for overseas customers. Sales are satisfied and customers continue to send in purchase inquiries even at the latest price levels.”

Southeast Asia market also benefit from the positive spillover effect from India and China with most new offers emerged at higher levels. Regional traders reported receiving good number of enquiries from Philippines customers. Meanwhile, Vietnamese buyers are also showing stronger willingness to make fresh purchases. A Chinese trader said, “This month we only have 1500 tons allocation to Vietnam and we are receiving very good respond from buyers. We think market has entered the up cycle and might sustain in the near term despite the slow season during the monsoon season.”

In a separate news, Vietnam’s Phu My Plastics and Chemicals Co Ltd (PMPC) has changed its trading name to AGC Chemicals Vietnam Co Ltd, starting 23 June 2016, after its parent company - Asahi Glass Co Ltd (Tokyo) completed 78% stake acquisition.

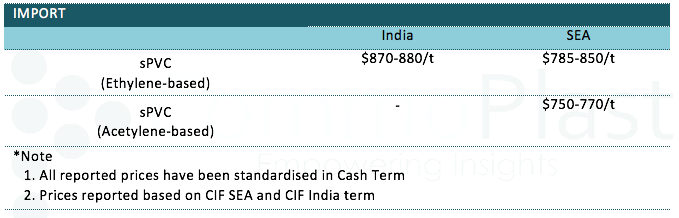

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.