Asia Weekly PVC Overview (Week 35, 22-26 August 2016)

Asia Weekly PVC Overview (Week 35, 22-26 August 2016)

Calm sentiment, strong costs boosted firmer expectation

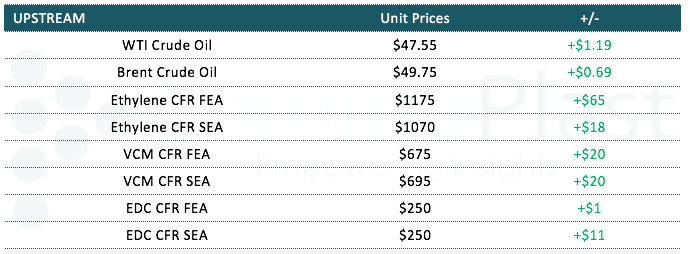

In Asia, the PVC market appears to be calmer this week, as most buyers have concluded September business at $40/ton higher than last month. The upstream market continues to firm up amid limited supply for both ethylene and VCM stemming from a series of maintenance shutdown. This has fuelled market expectation for firmer PVC trend in the near term.

In India, a major Korean producer announced new PVC prices to the country at $935/ton CIF India, LC AS term following the firming trend pioneered by Taiwanese major. However, it is reported that local demand is slower this week and buyers are showing very limited interest in prices above the $930/ton threshold. A trader in the country informed, “We decided not to proceed with purchases at this price level as our customers are showing resistance. We notice that buyers are not very active this week though the monsoon is coming to an end, and demand supposed to show sign of improvement. We prefer to be cautious before taking position.”

In China, local market remained largely stable from the week earlier, though several traders have attempted to increase their local prices by CNY50/ton ($8/ton) with the support of firmer futures market. An ethylene based PVC maker said, “Trading activities are weaker due to most buyers have replenished some cargoes in the earlier weeks. To us, September is still a promising month since buyers would have to restock before the National Day holidays. However, most Fareast Asia plants would resume operation in October, posing high possibility that market might be weaker by then.” Meanwhile, carbide based PVC supply has yet to see any improvement, in which players expect to see better supply condition only by the second half of September. A carbide based PVC producer added, “Carbide costs are still high and limited. We might need to cut operation rate if the condition doesn’t improve soon. At the moment, we have very small quantity of stock on hand, hence sales pressure is minimal.”

The general sentiment in Southeast Asia market remained weak despite limited availability from major Thailand producers. Vinylthai reportedly restart its 400,000 tons/year VCM line in Map Ta Phut, Thailand after encountered unexpected shutdown earlier this month. It is reported that the company’s downstream PVC plant was also affected due to lack of VCM feed, in which the company has to cut PVC allocation to export market this month. A trader in Malaysia informed, “We only received about 30% of PVC allocation this month from our supplier at $55/ton higher than last month. We think with the resumption of the VCM plant, PVC supply would normalize by the next price opening. Demand in Malaysia is weak due to sluggish property market. Our customers claimed to have sufficient cargoes at least till October, hence most are not interested to replenish material at the current levels.”

In another news, Indonesia’s Asahimas is planning a month long maintenance shutdown at its two VCM lines in September 2016. Both lines has a combined capacity of 400,000 tons/year.

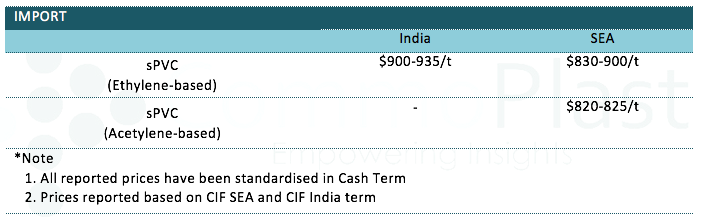

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.