Asia Weekly PVC Overview (Week 47, 14-18 November 2016)

Asia Weekly PVC Overview (Week 47, 14-18 November 2016)

In Asia, the PVC market witnesses another quiet week as players are waiting for fresh price announcement from major Taiwanese maker. On the other hand, monetary related issues such as the depreciation of local currencies across Asia and the demonetization of the high-value notes in India also negatively impact the near term outlook.

Medias are reporting that the demonetization and the tardy pace of notes exchange in India have left only one seventh of the currency in circulation, hurting cash businesses along the way. A trader in India informed, “This issues might remain in place in the next few months, therefore we are trying to switch to other payment method. Trading activities are slow, however, we do hope to see improvement in the coming month.”

India is about to enter the traditional high demand season for PVC. Initial expectation called for $40-60/ton hike from international suppliers; at the moment, this does not seem achievable in this market. Another source added, “We think the supplier might implement smaller than expected price increment for India this month. The will be some resistance, however, tight availability will have its way.”

In China meanwhile, most actively traded futures contract for January delivery plunged four out of five sessions this week, together with multi-years low Chinese yuan against the US dollar; the number of deals dropped visibly. Even with that, official offers from domestic producers still surged CNY200-400/ton ($29-58/ton) week on week basis for both ethylene and carbide based cargoes. Makers here technically find no encouragement to reduce their prices amid high production and transportation costs. That, however, does not applicable to traders. Several offers for carbide based PVC in distribution market were reported at CNY200-300/ton ($29-44/ton) below official price list from producers. A trader based in Eastern China open prices for carbide based PVC at CNY8000/ton ($992/ton without VAT), FD China, cash term said, “We are migrating our cargoes from futures to spot market today as prospect for futures trading remain bearish in the near term. Customers in spot market are very cautious, hoping to obtain more discounts. However, we think that tight availability from local producer might limit the extent of any price reduction.”

Southeast Asia remains the least active region compared to other neighbouring markets. Offers for regular origins hold steady amid weak buying interest; however the availability of USA cargoes at attractive levels caught player’s attention. A Malaysian converter received USA’s PVC offers at $900/ton CIF, LC AS term for December delivery said, “The shipping time is a little bit long; however, the firming trend in Asian PVC market might sustain into 2017. Demand for our end product is still regular, we just couldn’t transfer higher raw material costs into end product prices. We plan to talk to our USA supplier to make some purchases.”

The Indonesian market is in the stage of shock after the rupiah fell to five years low against the US dollar earlier this week. A trader said, “We maintain our offers stable at $950-1000/ton FD Indonesia, cash term; yet very few customers show interest. Traditionally, November and December is high demand season; but at the moment, our business is slower than previous month. Pipe and profile converters see no improvement in end product demand, hence very reluctant to build inventories.”

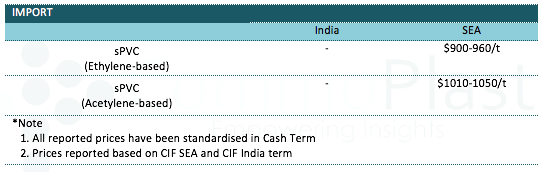

A summary of import PVC prices to the region is shown in the following table: