Asia Weekly PVC Overview (Week 08, dated 20-24 February 2017)

Asia Weekly PVC Overview (Week 08, dated 20-24 February 2017)

Demand in India continues to improve; March outlook in China might be soft

In Asia, more international suppliers lifted their March shipment offers after a major Taiwanese producer implemented $30-40/ton hike in the previous week. It is reported that buying interest in India hold steady on the improving path which carves positive expectation for March outlook. However, market prospect in China remains uncertain with couple of major events coming up.

In fact, small to medium size converters in Northern China area are instructed to shutdown during the China’s National People's Congress held during 3 – 16 March 2016 to ensure the air quality. “And in addition to slow end product demand in the post holiday period, many buyers refused to make large replenishment, which resulted is an unexpected build up in local inventory,” a trader commented.

Domestic PVC offers this week slipped CNY100-200/ton ($15-29/ton) for ethylene based and CNY200-400/ton ($29-58/ton) for carbide based cargoes due to weak demand and falling futures prices. The separate incidents took place at two carbide feedstock plants last week does not seem to impact the general sentiment immediately. Another trader added, “Couple of our customers have yet to resume operation after the holidays as some of their plant’s waste disposal processes do not meet the government’s new requirement and they might need more time to upgrade. This has balanced up with the supply tightness condition.” Producers therefore might find it more attractive to divert their cargoes to India, where strong demand has yet to peak.

Meanwhile in Southeast Asia, buying interest remains weaker than other neighbouring markets especially in Indonesia and Thailand. Regional producers have been portraying disappointment towards the demand condition in these markets even with the lack of availability. On the other hand, demand still presents in Malaysia, just yet buyers here are very aggressive in negotiation on the back of comfortable inventory. A major Thailand producer therefore has stepped back on their hike target by $10/ton to reach $950/ton CIF Malaysia, LC AS term. A manufacturer in the country added, “Even with the reduction, this offers are still higher than other Southeast Asian cargoes. We plan to negotiate further with the supplier before making some purchases.”

In India, import PVC inched higher with new offers from Fareast Asia producers while buyers are continuously seeking for cargoes in the post demonetisation era. An international supplier said, “The number of purchase inquiries we received from Indian buyers are very satisfactory this week. Domestic supply here remain pretty tight which might support further price increment in the coming month.”

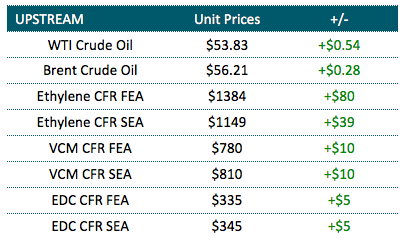

In related production status news, Taiwan’s Formosa has shut two of its VCM lines in Kaohsiung for maintenance work late last week. Both units with combined capacity of 480,000 tons/year are expected to remain offline until early April.

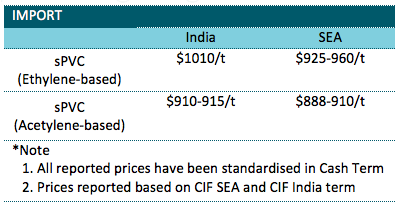

A summary of import PVC prices to the region is shown in the following table: