Asia Weekly PVC Overview (Week 10, dated 6 - 10 Mar 2017)

Asia Weekly PVC Overview (Week 10, dated 6 - 10 Mar 2017)

Players await fresh offers, SEA market received additional discount

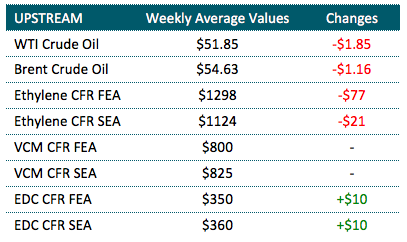

In Asia, market remains mostly stable with very limited trading activities as players decided to adopt wait and see stance ahead of April price announcement. Players stick to the notion that major Taiwanese producer would implement further hike on the fresh offers, in line with surging upstream costs, limited availability and improving demand in India.

In fact, a number of Indian sources commented that Taiwanese major might lift new offers to $1050-1060/ton CIF India term, which is $40-50/ton month on month hike as supply in this market is very tight. “This means new offers would reach multi-years high levels. Availability is limited in local ground, however, prices at the upper end of the overall range are facing resistance.” Indian players are amid financial year period, which explains to why buyers are not very aggressive in recent week. “China and Southeast Asia is not showing sign of any up-tick in demand condition, therefore, more cargoes shall be directed to India market this time,” a trader added.

Meanwhile in China, restocking activities remain low and the shutdown at small to medium size converters in Northern area is reported to have taken a token of about 30% on demand. “However, with the firming trend in the international ground, we might have better opportunity to export our cargoes,” a producer said.

As futures market surged during the first sessions of the week, traded above spot cargoes, domestic suppliers attempted to increase offers for carbide based PVC by CNY50-100/ton ($7-14/ton) to seal the price gap between the two trading grounds. “Initial respond is rather weak, yet we believed that demand shall pick up by second half of the month as the China's National People's Congress end and allow manufacturer to resume regular operation rate. The concern is that the recent fall in ethylene costs might limit the up side of the market in the near term,” a trader said.

Situation is not very bullish within Southeast Asia market with import carbide based PVC to Malaysia continues to soften by $5-10/ton from last week. Couple of deals for the cargoes are reported at $865-870/ton CIF Malaysia, LC AS term with a profiles manufacturer said, “With this purchase, we have comfortable inventory until end of May. International suppliers might attempt to firm up prices in the coming months despite slower demand across the region. We prefer to withdraw to the side line to monitor the market.”

Within local Indonesia, suppliers are hold firm on their cargoes in line with improving demand condition. A trader said, “Our sales grow 10 per cent from February as several governmental projects kick start. We are quite optimistic about April outlook, however, May would be challenging due to the fasting season.”

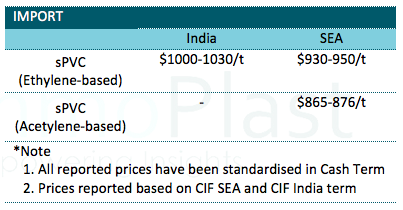

A summary of import PVC prices to the region is shown in the following table: