Asia Weekly PVC Overview (Week 12, dated 20 - 24 Mar 2017)

Asia Weekly PVC Overview (Week 12, dated 20 - 24 Mar 2017)

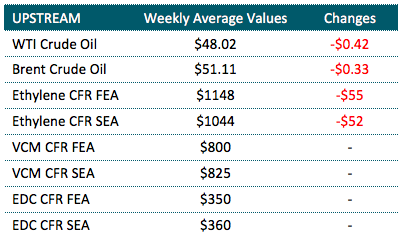

In Asia, demand across the region is weaker than expected from which most international suppliers have to step back on their initial hike for April shipment. It appears that Chinese suppliers for both carbide and ethylene based PVC are becoming aggressive in depleting their cargoes with prices emerged at very competitive levels.

Buying interest in India is surprisingly low despite the traditional high demand season. Players in the country are said to be more concentrating on the annual tax issues than to make fresh replenishment. “Buyers here also have a better choice of sourcing materials from local suppliers, which are more competitive than import cargoes at the moment. Falling upstream costs and persistent weak demand in other Asia markets also negatively impacts the general sentiment,” a trader explained.

Another Indian distributor added, “Sales in India is slow this month and even with the reduction, we are not seeing good respond from the market. Buyers are hoping to received better offers from South Korean suppliers as intense foreign relation with China is deterring smooth sales into this country.”

In fact, Southeast Asian producers who were attempting to exploit the potential in India market see disappointed feedback. “We received very low bids from Indian buyers this month, therefore we decided to divert our cargoes to Africa, where demand is still healthy,” a producer said.

In Southeast Asia, Chinese ethylene based PVC emerged at below the $900/ton threshold, touching $890/ton CIF Malaysia, LC AS term. “This is much more competitive than other origins, therefore we purchased some quantity,” a pipe converter said. For this, competition within the region is now intense, forcing some suppliers to implement larger price reduction than the benchmark set by Taiwanese major. A Vietnamese buyer informed, “Our Chinese supplier were offering at $940/ton earlier this week, however, willing to sell at $40/ton lower for volume purchases. We have also bought some Japanese cargoes this week, therefore, we are considering whether to replenish additional quantity.”

Southeast Asian buyers are rather concern over the market outlook in the coming month as it becomes uncertain if market could revive. Players are now monitoring closely the development in India in order to gauge the likely market direction in the near term.

Restocking activities within China market remain sluggish, yet suppliers endure the hope for better condition in the coming month as the weather warm up. Only ethylene based PVC offers dropped CNY100-150/ton ($14-22/ton) compared to last week while carbide based PVC hold steady. “We can’t cut our offers any further as prices would be lower than futures market,” a carbide based PVC producer commented.

In related plant status news, Sichuan Yibin Tianyuan and Inner Mongolia Yihua might shut its carbide based PVC plant with respective capacity of 380,000 tons/year and 300,000 tons/year by second half of March for a month maintenance work. Besides, Inner Mongolia Yili is planning to bring its 500,000 ton/year carbide based PVC line downstream on 27 March to resolve some technical issues. This might help to tighten supply in local China in the coming weeks.

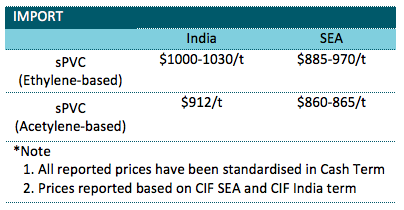

A summary of import PVC prices to the region is shown in the following table: