Asia Weekly PVC Report (Week 17, 18-22 Apr 2016)

Asia Weekly PVC Report (Week 17, 18-22 Apr 2016)

Stable trend with discounts on deals

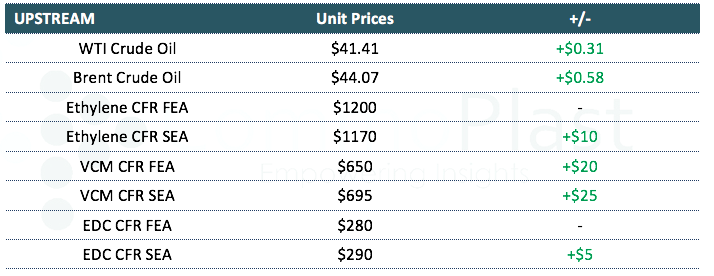

In Asia, the PVC market remained largely stable after regional market accepted the fresh hike from Taiwanese major. Most players are now in the process of clearing shipment procedure, however, weaker demand expectation in India has weighted down on deals this week with number of cargoes concluded at $20/t discount from initial offer levels.

In India, players reported slightly tightened local supply after Reliance unexpectedly shutdown its 345,000t/year PVC plant in Dahej due to water shortage. While players are very cautious about June shipment as this is traditional low demand season, many are showing disappointment about the current local buying interest. A trader commented, “We are seeing demand in April is not as strong as expected and this might drag to May. The arrival of previous imported cargoes has eased the tightness in local market to some extent. We are not really optimistic about the near term outlook.”

In China, buyers have already accepted the hike introduced by major international suppliers and firming futures market has encouraged local sellers to lift their offers by CNY50/t ($8/t) compared to last week, yet real demand has not shown any exceptional improvement. An ethylene based PVC producer commented, “Our customers continue to source on need basis due to low inventory on hand. Market shall be slower next week due to ChinaPlast, however we are not in the position to reduce price given a series of plant shutdown within the Fareast region.”

In Southeast Asia, sentiment is relatively more quiet and deals for both ethylene based and carbide based PVC cargoes are reported at discount. A Malaysian converter purchased Chinese carbide based PVC at $745/t CIF, LC AS term said, “Demand for our end product is slower than usual and we have sufficient material. However, we think the market might remain on the stable to firm trend in the coming month, therefore we decided to replenish additional quantity after obtain some discounts.”

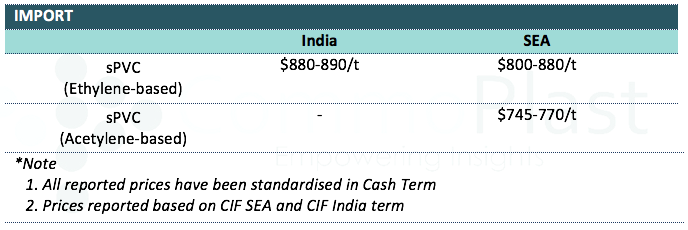

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.