Asia Weekly PVC Overview (Week 25, 13 - 17 June 2016)

Asia Weekly PVC Overview (Week 25, 13 - 17 June 2016)

Market wait July offers, softer expectation

In Asia, PVC business is rather quiet this week as players are waiting for major Taiwanese producer to open July delivery offers, which is expected to announce next week. Couple of offers emerged in the market at lower levels and players are generally expecting some $20-30/ton discount for the next shipment.

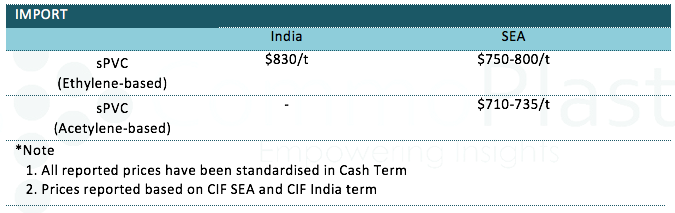

In India, demand is reportedly diminishing as the monsoon season dampens buying interest. Players are generally less optimistic about the near term outlook with a trader said, “Demand might only revive in September when the monsoon ends. For July, we are expecting to see at least $20-30/ton discount from Taiwanese major given weaker support from both upstream and downstream market.” The source also reported receiving sPVC offers from another Taiwanese maker at $830/ton CIF India, LC AS term and $33.62 anti dumping duties, which is about $30/ton lower than last month.

Domestic demand in China is weakening as buyers refrain from making fresh purchases amid slow end product demand, market sources said. Falling futures prices also pressurize supplier further in spite of low inventories level stemming from production cut in compliance to government environmental policies. A local producer reported, “We have cut our carbide based PVC offers by CNY50-100/ton ($8-16/ton compared to last week, yet the effect on the demand side is rather disappointed. Ethylene based PVC is very competitive now due to lower upstream costs, from which carbide based cargoes might continue to face downward pressure in the coming days.”

Southeast Asia market remains quiet as part of the region – Malaysia and Indonesia markets entered the fasting month, which is a traditional slow season. A buyer in Malaysia received carbide based PVC at $710/ton CIF term added, “We do expect further reduction for July delivery, however, this might be the bottom of the cycle as major Taiwanese maker is shutting down their PVC and VCM line this August for maintenance, which might tighten regional supply. We are now planning to monitor the market and might make small purchases before going off for the Ramadan holidays.”

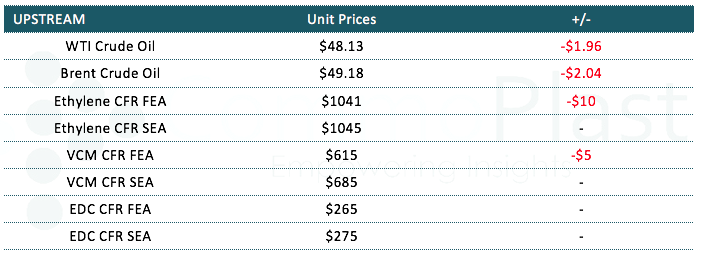

Market is expecting VCM supply within the region to increase in the near term in line with the restart of couple plants in Japan. Indeed, Keiyo Monomer has restarted its 200,000 tons/year VCM line in Chiba last weekend after almost a month maintenance shutdown. Meanwhile, Kashima Vinyl Chloride Monomer is schedule to bring its 600,000 tons/year VCM unit in Kashima next week.

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.