Asia Weekly PVC Overview (Week 28, 04-08 July 2016)

Asia Weekly PVC Overview (Week 28, 04-08 July 2016)

Market await fresh offers, supply in China tightened on delivery disruption

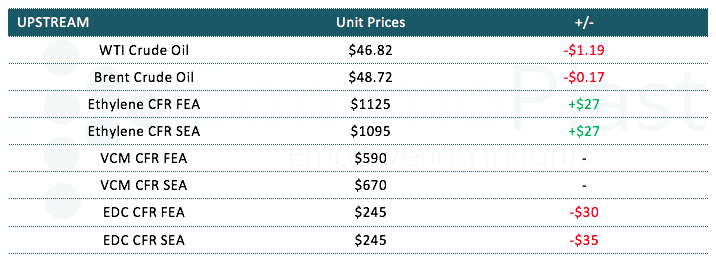

In Asia, PVC prices continue to move higher though trading activities were thin in part of the region due to the Ramadan holidays. Most players are waiting for major Taiwanese marker to announce fresh offers for August delivery; however, many are looking at firmer trend amid expected tightened supply condition.

In India, a Taiwanese producer opened new offers for first half of August delivery with $20/ton higher than late last month to reach $870/ton CIF, LC AS term, excluding antidumping duties of approximate $34/ton. A trader received the new offer commented, “Demand is rather stable by now, however the fact that constraint supply from international supplier is pushing prices up.” Players in the country believed that prices have reached the bottom though pipe and profile converters are seeing mediocre demand for their end products during the monsoon season.

In China, demand is reported to be better with the support of persistent firming trend in both future and spot market. Domestic producers continue to lift offers for their cargoes by CNY100-200/ton ($15-30/ton) compared to last week, claiming improved sales. A carbide-based producer reported, “Most ethylene based makers are diverting their attention to India as demand in this market is healthy. These have caused reduced availability of these cargoes in local market and encourage buyers to switch to carbide-based parcels.” Supply tightness in local China market might persist in the near term as the recent flood in Southern China has caused railway delivery disruption from Inner Mongolia and Xinjiang to Shanghai, Wuhan and Guangzhou, sources said. For this, many sellers are planning to hold firm on their cargoes hoping to achieve better margins in the near term.

Sentiment in Southeast Asia is rather quiet with couple of major markets are on holidays. However, players are raising concern over the state of demand in local ground as the monsoon season dampens buying interest. A Vietnamese trader commented, “We have purchased sufficient cargoes with expectation that prices would move higher in the near term. However, at the moment demand is rather sluggish and this condition might take longer to recover till the raining season is over.”

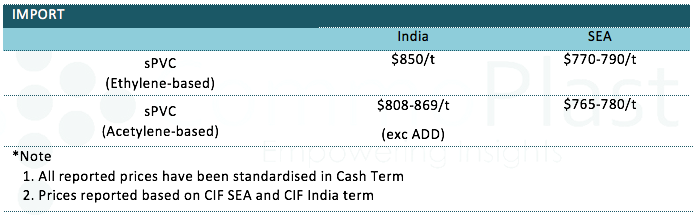

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.