Asia Daily PP PE Report 28 Dec 2015

Asia Daily PP PE Report 28 Dec 2015

CommoPlast

Today, futures prices on Dalian Commodity Exchange start the final week of the year with decreases compared to the last trading session. Contract number 1605 for May delivery dropped CNY129/t ($20/t) to close at CNY5807/t ($765/t without VAT) for PP, while LLDPE futures reversed the firming trend recorded in the past two weeks to settle at CNY50/t ($8/t) lower at CNY7820/t ($1030/t without VAT).

Sentiment in local market is calm with no drastic movement recorded in domestic spot PP and PE offers. A Shanghai trader commented, “We see that inventory from local major makers has a large drop as they managed to deplete cargoes during the past week. We expect slower trading activities this week due to the up-coming New Year holidays.”

Players are reportedly taking cautious stance over the market outlook in the coming month given many buyers will be away from their desk starting mid-Jan 2016 for Chinese New Year celebration. A trader in Xiamen said, “The PP market has gained some stability in the past few trading days despite local offers are still more competitive than import cargoes. However, looking at the medium term, we think PP market is still weak under more pressure from new coal based and PDH plants.” Good demand for prompt LLDPE film cargoes has kept offer for this grade very firm, according to market sources.

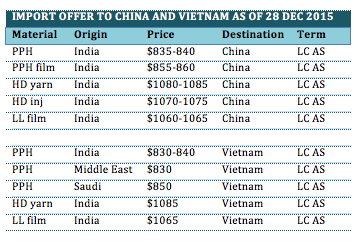

In Vietnam, local PP and PE prices increased by VND200,000-300,000/t ($9-13/t) compared to last week on the face of firmer upstream figures. There are very few import offers observed today as players are still judging the market condition before open new prices. A trader active in PP market reported, “We are planning to replenish addition cargoes at the price $830/t, however, our Middle East supplier has sold out last week and they are yet to announce new price today. We think PP market is near to the bottom and there is minimal room for price to go down further.” Meanwhile, a major Indian maker decided to elevate their homo-PP price by $10/t from last week’s done deal to $840/t CIF Vietnam, LC AS term.

In the PE market, local traders are still bearing loses even after some gain reported since late last week, according to players. A source said, “We received more enquiries from local buyers these few days but we are selling at negative margin as these cargoes were previously purchased at $1210/t level. We hope the market condition will improve in the near term with the support of tight ethylene supply in the region.”

*Please note that CommoPlast will not have Daily report on 31 Dec and 1 Jan. Thank you for your support.

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.