Asia Daily PP PE Report 23 Dec 2015

Asia Daily PP PE Report 23 Dec 2015

CommoPlast

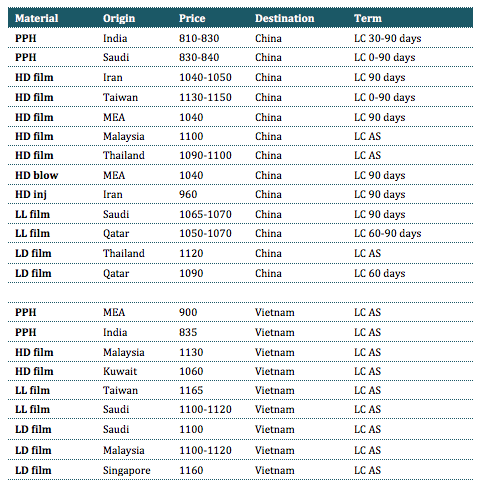

In China, May futures prices on Dalian Commodity Exchange continue to go north today with PP futures increased CNY22/t ($3/t) to settle at CNY5738/t ($757/t without VAT). LLDPE futures gain CNY120/t ($19/t) to close at CNY7785/t ($1027/t without VAT). The firming trend in the futures trade has started to show impact on local spot PP and PE market with more deals reported amidst stable offers from domestic makers.

It is reported that inventory in local market is not high at the moment which encourage some traders to attempt to firm up their offer. A trader in Shanghai added, “We managed to close some deals for Thai PE cargoes at $1120/t for LDPE film and $1090/t for HDPE film, both CFR China LC AS. We are still keeping cautious stance as we expect some correction to take place in the futures market.”

In the past one month, local LDPE film grade has followed a very stable trend compared to other materials and currently stand at CNY9450-9500/t EXW China, cash term ($1245-1250/t without VAT). This is due to fewer new capacities producing this grade, including those PE coal based plant, according the market players. Till this moment, there are only two MTO plants with LDPE grades on production schedule to be commissioned by 2016, which are Shenhua Xinjiang Coal Co Ltd with 250,000 tpa LDPE and Zhongtian Hechuang Co Ltd with 370,000 tpa LDPE.

In Southeast Asia market, sentiment remains weak as the holidays season is drawing nearer, however, firm upstream value is providing some support to the PP and PE market. PE suppliers with prompt cargoes are very reluctant to adjust their price down pointing to lower risk associated with their parcels and steady upstream costs. A major regional producer has stepped back on their LDPE film price by $10/t from initial offer to $1120/t while maintaining HDPE film price at $1130/t CIF Vietnam, LC AS term. Some buyers have already accepted this price level with a trader reported, “We only purchased two container of this grade as we are not confident about the market outlook in the near term albeit number of cracker shutdown in Q1 2016.” Meanwhile, others buyers are still in negotiation for further discount.

There is little movement in the PP market reported today while propylene (C3) based on FOB Korea term gain $5/t to reach $585/t as of 22 Dec 2015 due to tight supply in Asia. A Southeast Asian trader received Philippines homo-PP offer at $950/t CIF SEA term, commented, “We find this level to be a bit high and we expect resistance from buyers. We are in mid of negotiation with out supplier for some discount but we are not optimistic about the market outlook in the coming month.”

Another buyer in Vietnam added, “Our Middle East supplier still maintain their homo-PP offer at $900/t CIF term but we are placing bid at $80/t lower. Local PP market is weak and buyers are pressurizing for lower price despite the depreciation of the VND.”

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.