Asia Weekly PVC Overview (Week 34, 15-19 August 2016)

Asia Weekly PVC Overview (Week 34, 15-19 August 2016)

Taiwanese major lifted September prices, sold out in India

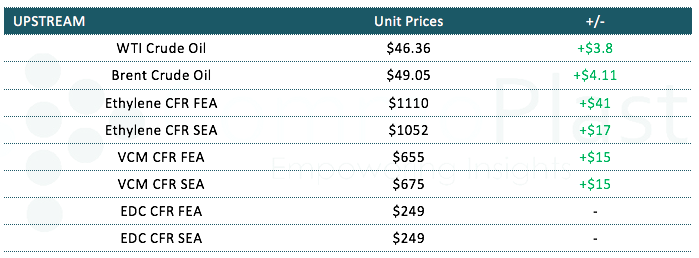

In Asia, a major Taiwanese major announced September delivery cargoes at $40/ton higher than last month, beat all initial expectation of only $20-30/ton. The market respond was not so positive at first, yet reduced allocation has opened the path for concluding deal later. The monsoon season in major regional market is expected to come to an end soon, which encourages optimistic outlook for the coming months.

In India, players reported receiving approximate 20,000 tons of material from major Taiwanese maker, which is about 30% below the regular allocation. Despite the on going monsoon season, the supplier reportedly sold out all available quantity shorty after the price announcement. A trader informed, “There is no discount on deals. Demand is rather stable as we think converters are building stock ahead of the high season starting September. Besides, tight supply is also supporting the supplier in achieving their price hike target. Outlook for the coming months is positive.” Players in this market are currently waiting for other major Fareast Asian makers to announce new prices, mostly expected similar hike with the Taiwanese producers.

In China, healthy demand continues to carve way for producers to increase their prices this week. Indeed, price lists for both ethylene and carbide based cargoes indicated some CNY50-100/ton ($8-15/ton) increased compared to last week. For this, export offers out of the country also firmed up by $10-15/ton, especially for carbide-based material. A maker from Inner Mongolia commented, “Our overseas customers have yet to give feedback on the latest prices as many prefer to wait for fresh offers from a Taiwanese major. Meanwhile, we continue to achieve satisfactory sales in domestic market, hence we plan to hold firm on our export cargoes.” Export prices for carbide-based PVC currently stand at $790-795/ton FOB China, LC AS term.

Southeast Asia is the most sluggish market within the region, according to international traders. Although, there are some signs indicating a pick up in demand in Vietnam, other markets including Indonesia remains more of quiet. It is reported that major local producers in Indonesia have lifted their prices by approximate $40/ton compared to last month, however, buyers show very little interest, especially those in the PVC pipe sector. A converter received offers from two different local makers at $900/ton and $920/ton respectively, all based on FD Indonesia, cash term. The source said, “Domestic market gains support from firming international trend in spite of slow buying interest. Demand for our end product is so weak that we have been operating at 50% rate for sometime now. We plan to source on need basis till end product business improve.”

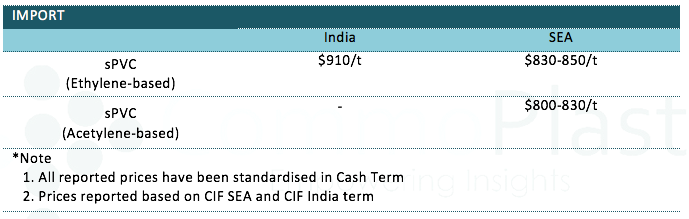

A summary of import PVC prices to the region is shown in the following table:

For detail Daily Prices in China and Southeast Asia market, kindly visit our website at www.commoplast.com. Please contact our representatives at commoplastinfo@gmail.com for log in assistance.