Asia Daily PP PE Report 22 Dec 2015

Asia Daily PP PE Report 22 Dec 2015

CommoPlast

In China, May futures prices on Dalian Commodity Exchange continue the second day of firming trend with PP settled at CNY164/t ($25/t) higher and LLDPE futures increased CNY180/t ($28/t). Contract number 1605 for PP concluded at CNY5744/t ($758/t without VAT) while LLDPE closed at CNY7745/t ($1020/t without VAT).

The market is circulating news about a major maintenance shutdown to take place between Q2-Q3 2016 at Chinese prominent plants. It is estimated that a total of 1.33 million tons of LLDPE and LDPE could be taken off from the stream during these shutdowns, however, there is no official confirmation regarding this issue yet.

Physical spot offer for PP and PE in domestic market remained largely stable with players reported tight supply for prompt LLDPE film cargoes due to healthy demand in Northern region. There is also pre-Chinese New Year replenishment activities observed today but most cargoes takers are traders. A trader in Shanghai said, “Import offer for PE remained largely steady and sellers are willing to give $10/t discount on serious deals. We think that PE market might sustain the stable trend in the near term, but we are keeping caution about the outlook in the coming month.”

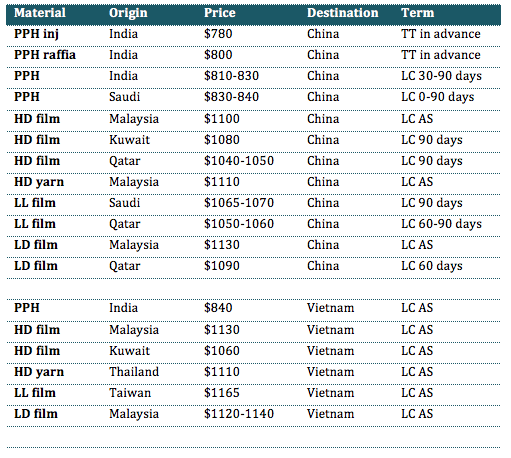

In the PP market, some irregular Indian homo-PP cargoes offered at $780/t for injection grade and $800/t for raffia grade, CFR China, TT in advance, slightly below the current market level. A trader in Ningbo commented, “Most Middle East cargoes are still holding firm at $830-840/t CFR China but it is very difficult to conclude deal at this level. We are expecting some discount in the coming days.”

In Southeast Asia market, a regional producer announced new PE prices with $80/t lower compared to last month to reach $1130/t for both LDPE film and HDPE film, CIF Vietnam, LC AS term. Initial response from the market towards the new price level seems not promising with local traders complained about selling at loses in domestic market. Source from this producer commented, “For PP, we put more priority on local Malaysia and Indonesia markets, however, sentiment is not encouraging. We are planning to reduce operation rate at our PE plant and we are not optimistic about the outlook in the near term considering the number of coal based plant to come online in China.”

PP market remained very firm with minimal changes in import offers reported. A major domestic producer in Indonesia reportedly increased local offer for PP by IDR140,000/t ($10/t) compared to last week due to weakening Rupiah, however, some traders elected to maintain their offer unchanged to attract buying interest. A buyer in Vietnam added, “Our suppliers invite us to place bid for Philippines homo-PP and we are being very conservative for now. Local PP prices continue to soften despite the depreciation of the VND these few days. We are not that optimistic about the outlook in the coming month.”

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.