Asia Weekly PVC Overview (Week 21, dated 22 - 26 May 2017)

Asia Weekly PVC Overview (Week 21, dated 22 - 26 May 2017)

Taiwanese major rollover offers for June shipment, Chinese materials witness hike

In Asia, a major Taiwanese producer decided to rollover offers from May to regional market with reduced allocation to India. The maker reportedly sold out the allocation to India while Southeast Asian buyers are resisting the new prices strongly claiming weak end product businesses and comfortable inventories. Meanwhile, Chinese suppliers lifted offers to SEA market though with very limited number of deal reported.

Despite the fact that Taiwanese major has sold out PVC allocation to India shortly after the new price announcement, Indian buyers are still complaining about weak demand condition. A trader commented, “It is the monsoon and Ramadan season ahead, which caused slower buying interest. However, our principal supplier only has 60 per cent of the regular quantity, or 18,000 tons allocated to India this month, hence, managed to sell out without much hassle.”

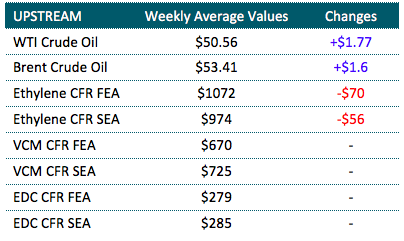

Other Fareast Asian producers lifted prices to India earlier this week have stepped back on their offers as market is not ready to accept any hike at the moment. “At the meantime, there are cargoes from Japan, Iran and Brazil at very competitive prices. It does look like buyers are having wider choice of origin at the moment. Together with the plunge in the upstream ethylene costs, price increment is not being supported.”

Meanwhile, in Southeast Asia, players reported receiving stable offers from regional producers though Chinese suppliers decided to implement at least $20/ton on ethylene based PVC cargoes from earlier this month. An international trader offered Chinese ethylene based PVC to Vietnam at $850-860/ton CIF, LC AS term said, “We have yet to be able to conclude any deal this week. Domestic materials are not much different from our offers, hence buyers show less favor to our cargoes.”

It appears that Chinese carbide based PVC offers below the $800/ton threshold are no longer available across Southeast Asia this week, players said. One of the factors encouraged Chinese producers to introduce price hike despite most others are maintaining offers is that domestic China market gain tremendous support over the pass week from surging futures market.

A carbide based PVC producer open new export offers at $800-810/ton FOB China, LC AS term, which is approximately converted into $820-830/ton CIF Southeast Asia, said, “We suffered severely from negative margin over the past month and we could not bear the loses amid rising production costs. Besides, local supply is tightening due to couple of maintenance shutdown going on. International buyers are not responding very positively to our offers, yet we plan to temporary maintain firm stance.”

Domestic sellers in China attempted to implement CNY50-100/ton ($7-14/ton) hike earlier this week on the back of healthy futures market. Yet, dull demand condition claimed the entire hike later of the week. This is not very favorable for suppliers to increases prices to both local and export ground.

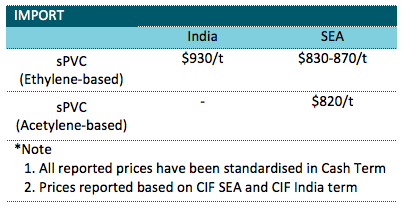

A summary of import PVC prices to the region is shown in the following table: