Asia Daily PP PE Report 11 Jan 2016

Asia Daily PP PE Report 11 Jan 2016

CommoPlast 11.01.2016

In China, futures contracts on Dalian Commodity Exchange for May delivery settled lower today. PP futures soften CNY25/t ($4/t) to close at CNY5633/t ($730/t without VAT) while LLDPE futures drop CNY40/t ($6/t) to CNY7815/t ($1010/t without VAT).

Physical spot offers for PP and PE in domestic market shrugged off CNY100-200/t ($15-30/t) from last week due to weaker sentiment, players reported. A converter in Shandong said, “We received offer for coal based homo-PP from local seller at CNY6000/t including VAT, EXW China ($775/t without VAT) which is much more competitive than import material. We prefer to buy on need basis from local market for now, as we are not certain about the outlook in the near term. Demand for our end product is regular.”

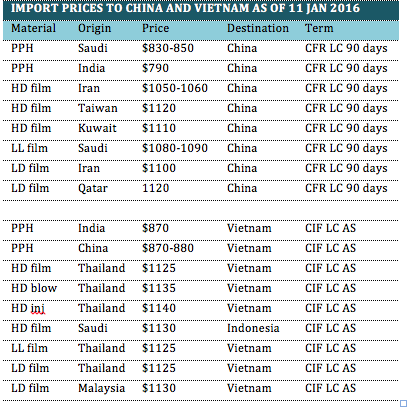

There is little movement in the import market reported today and the depreciation of the Chinese Yuan has enforced the hesitation in making fresh purchases among buyers. Most sellers are feeling disappointed with the number of deals they could conclude at the first trading of the week with a trader in Xiamen added, “We are offering some discount on our PE cargoes today to entice demand as we see a slow down in buying interest compared to last week. We expect to see another round of inventory replenishment by the second-half of this month before buyers go off for the long Chinese New Year holidays.”

In Vietnam, buyers are psychologically hit by the falling of crude oil and stumbling of global stock market. Many buyers who are contacted by CommoPlast are too shy from taking

new parcels in spite of stable to firmer PP and PE offers given by overseas suppliers. A converter received Indian homo-PP price at $870/t CIF Vietnam, a $25/t higher compared to before the New Year holidays said, “We only have sufficient stock for our production till mid-Feb but it is too risky to buy at the moment. With the weakening of crude oil and propylene costs, we expect to see some downward pressure on the PP market in the coming days.”

Propylene price based on FOB Korea term dropped $45/t over the past week to reach $545/t, erasing all the gains recorded in the past three months. International players are hoping that the falling of propylene prices will be slow down with a number of plants under shutdown during this period.

In the PE market, regional and international suppliers open new offer for this week at stable to firm trend claiming limited allocation and firm ethylene costs as the main support. A Southeast Asian producer plans to increase their LDPE film offer by $10/t to $1130/t CIF Vietnam said, “Initial response from the market is not so positive but we hope buyers will take up some cargoes in the near term.” Another regional maker open offer for HDPE grades at $1135/t for HDPE blow molding and $1140/t for HDPE inj, CIF Vietnam, LC AS term. The source added that they have yet to offer any HDPE film cargoes this week.

In Indonesia, a major local producer adjusted their PP price down by IDR320,000/t ($23/t) compared to last week while maintaining their PE price stable. A trader commented, “We are offering at the producer’s price list at the moment but market is rather quiet at the beginning of the week. We will need to monitor further to have clearer direction. Last week we managed to close a good number of deals and we hope that trading activities will improve this week. We think PE market will have a better outlook in the near term than PP.”

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.