Asia Daily PP PE Report 12 Jan 2016

Asia Daily PP PE Report 12 Jan 2016

CommoPlast 12.01.2016

In China, futures prices on Dalian Commodity Exchange contract 1605 for May delivery reduced CNY49/t ($7/t) to settle at CNY5569/t ($723/t without VAT) for PP. LLDPE futures contract in contrast, advanced CNY60/t ($9/t) to reach CNY7825/t ($1016/t without VAT).

Local PP prices continue to decline another CNY100-200/t ($15-30/t) compared to yesterday while domestic producers elected to maintain their PE offers unchanged. Buyers have been informed that there will not be any downward adjustment on LLDPE prices in the near term despite better supply condition in local market, players reported.

A trader in Ningbo said, “Even regular homo-PP is now traded at CNY6000/t ($780/t without VAT) EXW China. Demand is not very strong and falling crude oil is exerting even more pressure on the market.” Another trader in Xiamen added that they are looking to expand customer based by offering coal-based homo-PP to Southeast Asia market.

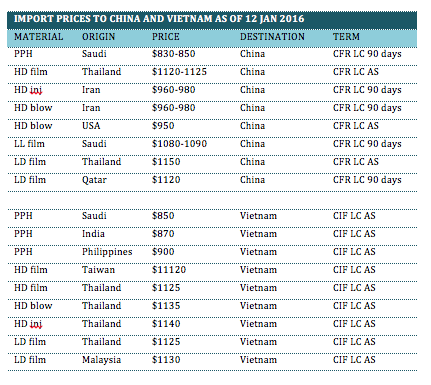

A Thai producer open new PE offer to China today at stable to firmer level compared to last week at $1120-1125/t for HDPE film and $1150/t for LDPE film CFR China, LC AS term. “The supplier did not offer other grades to us but we see deep-sea HDPE blow and HDPE inj cargoes are at below $1000/t threshold. We are monitoring the market cautiously, not having enough confident in the near term given the Chinese New Year holidays is drawing near.”

In Vietnam, import market did not see much movement today with most suppliers are very firm on their offers. A major Saudi Arabia maker announce new homo-PP price at $850/t CIF Vietnam, LC AS term, steady from earlier week. A buyer place bid at $820/t for this material commented, “We heard rumour that our supplier will be having a maintenance shutdown in the coming days, hence they are not in the mood to give any discount. Plus, with a number of unplanned shutdown taking place these few days, we think that PP market will sustain the stable trend in the near term despite plunging crude oil.”

Import PE market has not experienced any abrupt changes today, however, local offers are down VND300,000-500,000/t ($13-22/t) compared to last week. A trader offering Middle East HDPE film at VND27,500,000/t ($1115/t without VAT) and LLDPE film at VND28,700,000/t ($1160/t without VAT), FD Vietnam said, “Local prices have come down a bit compared to last week but demand is still steady. We are not willing to give any further discount on our LLDPE film cargoes as we do not have much quantity on hand.”

Meanwhile, a converter active in the PP market in Indonesia reported, “Even when compare to non-dutiable cargoes, local material is now more competitive. We plan to only source in local market in the near term given uncertain outlook and associated risks of import cargoes.”

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.