Asia Weekly PVC Overview (Week 28, dated 10 - 14 July 2017)

Asia Weekly PVC Overview (Week 28, dated 10 - 14 July 2017)

International supplier lifted August offers, demand in India, SEA weakened

In Asia, major Taiwanese producer announced August shipment offers to the region with $20/ton increased from last month despite weak demand condition in Southeast Asian and India, claiming tightening supply. Indian buyers portrayed mixed respond towards latest offers, yet expecting further price hike in the coming months.

The Taiwanese producer closed orders to India two days after the price announcement and many players are doubt if the maker completely sold out allocation to the country. A trader commented, “Demand in India is not great and many of our customers have temporary stopped production to deal with the implementation of GST.” Another distributor added, “There are still quantity, however due to lacking of sales pressure, our principal supplier decided to close orders. Sales are very poor this month.

There are unofficial market talks that the Taiwanese producer only have 15,000 tons of PVC allocated to India this month, 20,000 tons to China and another 20,000 tons to Southeast Asia and other market. This is well below the regular export allocation, which attributed to the fact that the maker is planning maintenance shutdown in August.

At the meantime, several Indian sources have brought up discussion about market outlook in the coming month, which underline the possibility of additional price increment, defying the fact that India market would turn quiet ahead of the monsoon season. To support this notion, players are poiting to tightened supply for Chinese carbide based PVC and as well as the upcoming shutdown at a major Taiwanese plant.

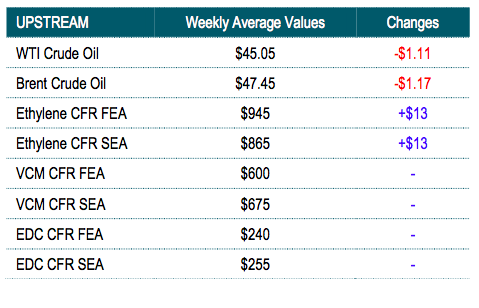

In China, suppliers have been lifting local prices for three weeks in a row thanks to strong futures trading and tightening domestic supply. Compared to the third week of June (week 25), local ethylene based PVC has increased CNY600-650/ton ($88-96/ton) while carbide based PVC surged CNY800/ton ($118/ton). Chinese players are expecting PVC prices to surge above the CNY7000/ton ($880/ton without VAT) threshold in the coming days pointing to the fact that local supply might continue to tighten. A market source said, “Demand is healthy in China as constantly firming futures market activated arbitrage activities. Besides, it is the traditional peak season and we think more converters would return to make replenishment this week.”

Southeast Asia market again trails behind others in term of demand. Indonesian and Malaysian buyers returned from the Ramadan holidays waiting on the sideline due to weak end product business. A Malaysian buyer reported to have received Chinese carbide based PVC at $870/ton CIF said, “Our supplier lifted offers by approximate $80-90/ton from last month. This is not competitive and we prefer to source material from Southeast Asian supplier this time.”

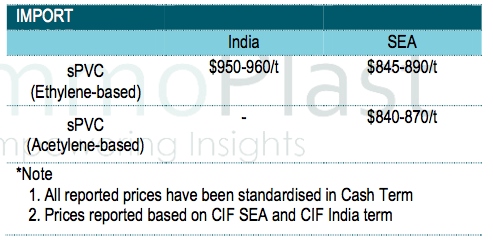

A summary of import PVC prices to the region is shown in the following table: