Asia Daily PP PE Report 30 Dec 2015

Asia Daily PP PE Report 30 Dec 2015

CommoPlast

In China, contract number 1605 on Dalian Commodity Exchange for May delivery firm up today with PP futures gain CNY60/t ($9/t) to reach CNY5883/t ($775/t without VAT), while LLDPE futures advance CNY195/t ($30/t) to settle at CNY7965/t ($1050/t without VAT).

Spot offers for PP and PE in domestic market did not see much changes today except a CNY100/t ($15/t) higher for LLDPE film on the back of tight supply. A trader in Xiamen confirmed this by stating, “Most of the prompt LLDPE film cargoes have been diverted to Northern region due to good demand. We have very limited quantity of in hand now and we expect local prices for this grade will remain firm in the near term.”

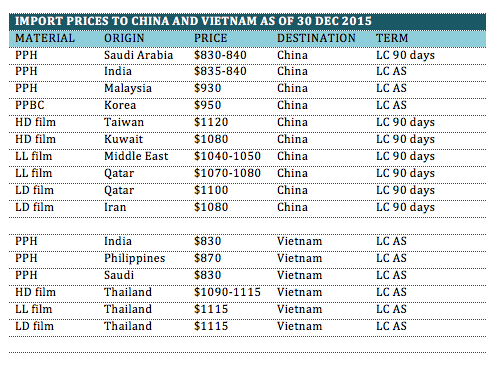

Buying interest in the import market is reported to be weaker, however, overseas suppliers maintain very firm stance on their offers with only small discount given to serious buyers. A customer reported, “We are seeking to purchase some LDPE film cargoes and so far managed to concluded Middle East cargoes at $1070/t CFR China, LC 90 days. We are not very optimistic about the outlook in Jan 2016 since it is a short month. However, we expect a pick up in demand after Chinese New Year."

Market reported Ningbo Fude Co Ltd has cut operation rate at its 400,000 tpa MTO homo-PP plant to 50-60% for system upgrading work. The company reportedly limits taking order for homo-PP from spot market recently, source close to the company said.

Sentiment in Southeast Asia market started to be calmer as players are entering the holiday mood. In Vietnam, some overseas homo-PP suppliers have stopped offering while others keep their prices on the stable to firm trend. A buyer receive offer for Philippines homo-PP at $40/t higher than last week at $870/t CIF Vietnam, LC AS said, “We plan to replenish a small quantity of this material but we are in the negotiation process with our supplier to close deal at last week’s level. We think that PP market might remain stable in the near term with the support from higher upstream cost.”

After one of the major Saudi Arabia producer announced Jan price yesterday, buyers have confirm purchasing some LLDPE film and HDPE film quantity, however the suppliers has yet to revert on the quantity available due to the extended shutdown at their plant. Meanwhile, a domestic PE maker in Indonesia has reduced their offer for local buyer by IDR270,000/t ($20/t) for HDPE film, HDPE blow molding and LLDPE film and IDR410,000/t ($30/t) for HDPE inj and HDPE yarn. A converter received the new price commented, “After the discount, local HDPE film and LLDPE film prices are still at about $1230/t without VAT which is considerably high compared to import market. We still have sufficient stock hence we prefer to wait till late Jan to make additional purchases.”

*Please note that CommoPlast will not have Daily report on 31 Dec and 1 Jan. Thank you for your support.

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.