Asia Weekly PVC Overview (Week 20, dated 14 - 18 May 2018)

Asia Weekly PVC Overview (Week 20, dated 14 - 18 May 2018)

Major Taiwanese maker surprisingly slashes June shipment offers; regional market enter the off-peak season

In Asia, a major Taiwanese producer surprisingly cut offers for June shipment by $20/ton to Southeast Asia and China, and $30/ton to India. Players are caught off-guard as most were expecting stable to firmer trend considering the smooth sales result in the previous month and the tightening supply across the region. On the other hand, demand in India and Southeast Asia might continue to decline in the near term amid the monsoon and the Ramadan season.

Demand in India is weakening, sources here said, due to the monsoon season. “Export allocation is regular this month at 65,000 tons. At the moment, we hope that limited supply from Japan and China would provide some support to the general sentiment,” a distributor said.

“In the meantime, we expect other suppliers including both local and overseas to follow the trend pioneered by the Taiwanese major. Sales are slowing down and we are not very optimistic about PVC outlook in the medium term as there are a number of factors that affecting demand here,” another Indian trader added.

Meanwhile, domestic suppliers in China stepped back on spot offers for both ethylene and carbide based cargoes by CNY100-200/ton ($16-31/ton) from last week as the previous hike faced stiff resistance from the market. “Continuous falling futures trading have negatively impacted the sentiment in the spot ground. We were hoping that overseas sellers would maintain prices on the stable to firmer track due to tightened supply, however the latest offering is rather disappointed,” a Chinese trader said.

“Our customers are demanding for further discount considering the development in the import market. However, our costs remain high while we are not having long stocks on hand,” an ethylene based PVC maker added.

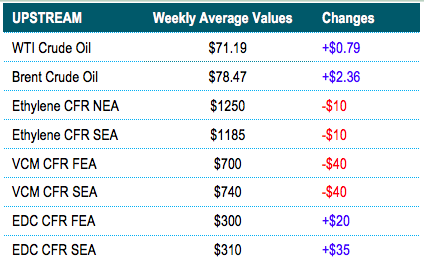

As mentioned in the previous report, demand for PVC in Southeast Asia might continue to decline in the coming week as major markets including Malaysia and Indonesia are entering the traditional low demand season. “We think the down trend has just only started regardless of the support from upstream energy complex. We plan not to rush into any transaction this week, instead wait for more new offerings to emerge in order to gain bargaining power,” a Vietnamese buyer received offer for Taiwanese PVC at $910/ton CIF said.

In addition to the plant news that Taiwan’s Formosa Plastics Corporation plans to take its 500,000 tons/year PVC unit in Mailiao off-stream during the final week of June 2018 for 7 days, the company will also shut its 340,000 tons/year VCM unit for a month during the same period. This is in line with a shutdown of state-owned CPC's ethylene pipeline for an inspection by the government. The shutdown might tighten VCM supply in the region.

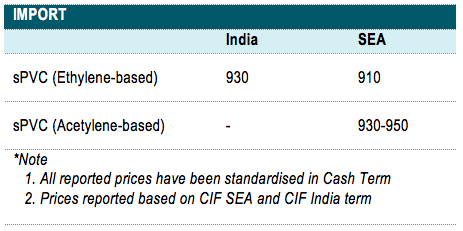

A summary of import PVC prices to the region is shown in the following table: