Weekly PVC Overview - Week 37 - 2018

Weekly PVC Overview - Week 37 - 2018

October shipment offers plunged, regional buyers remain cautious

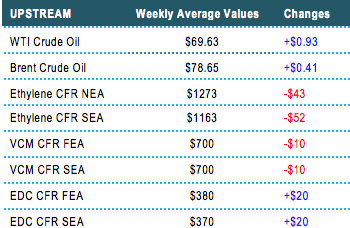

In Asia, major Taiwanese producer announced October shipment offers with drastic reductions that surprised many players. While the $60/ton cuts for Indian buyers are very much in line with the initial expectation, the $90/ton drop to Southeast Asia and China is rather jaw-dropping. Regional buyers are watching out for further development with hope to obtain additional discounts from other suppliers.

In India, demand has been weak; much of it is contributed by the steep depreciation of the Indian Rupee coupled with the monsoon season. “Even with the sharp price cut, we are struggling to attract sales. Demand is very bad here and we think major Taiwanese maker might need more time to deplete the quantity,” a trader informed.

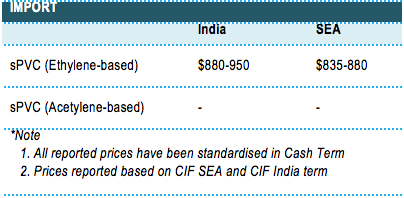

In Southeast Asia, the market remains dominated by the widely available of USA cargoes at competitive levels. Deals for this material have been achieved at as low as $835/ton CIF Vietnam, LC AS. “Except for the long shipping time, we think the price is acceptable. Demand from pipe maker in the local ground is not too strong due to the typhoon season, however, sentiment shall be better,” a local trader in Vietnam said.

Meanwhile, regional suppliers have conceded to $50-60/ton cuts with cargoes originated from Indonesia and Thailand are seen at $880/ton CIF Malaysia, LC AS while South Korean materials are priced at $860/ton with the same term. Demand in Malaysia is not all strong, sources said, as many buyers have stocked up cargoes before the Sales and Service Tax take effective on 1 September. “The government has green-lighted hundred of projects that were previously on-hold for inspection, yet, players wanted to see a clearer market direction. Budget 2019 will be announced in the first week of November and we think purchasing activities would be better,” a source said.

In China, the domestic market holds steady amid the sharp reduction from the import ground. At the time this report is published, local cargoes are available at CNY6800-6900/ton ($856-868/ton without VAT) for carbide-based and at CNY7250-7400/ton ($912-931/ton without VAT) for ethylene-based, EXW China, cash equivalent. Unlike other petrochemical products, pre-holiday replenishment for PVC is not as strong as expected. “The inventories pressure among overseas sellers is rather obvious. We are waiting for the additional discount to emerge,” a buyer said.

An inventories survey based on selective sample (including several plants, warehouses, and converters) found that total inventories at producer’s warehouses reduced approximately 28% from last week, while trader warehouses and converters side down 0.85%.

Sources do not expect any major price change in the coming week citing the reinforcing effort from the government on the environmental control that might limit the run rate at major plants and tighten availability.

A summary of import PVC prices to the region is shown in the following table: