Asia Daily PP PE Report 18 Jan 2016

Asia Daily PP PE Report 18 Jan 2016

In China, futures prices of Dalian Commodity Exchange for May delivery firm up considerably today in spite of crude oil futures dived to the lowest level seen in more than a decade. PP futures increased CNY111/t ($17/t) to close at CNY5744/t ($750/t without VAT) while LLDPE futures jumped CNY245/t ($37/t) to reach CNY7930/t ($1030/t without VAT).

Physical spot offers for both PP and PE in local market remain largely stable and some sellers elected to lift their offers by CNY50/t ($8/t). It is reported that many factories will start to close for Chinese New Year this week, raising a great expectation about pre-holidays replenishment in this market. In fact, demand in local market is picking up and the number of deal concluded today appears to be healthy for both regular and coal based cargoes. A trader in Xiamen said, “We manage to close a good number of deals in local market today; however, weakening Chinese Yuan has discouraged buyers to be active in the import market. We are depleting cargoes in hand now and remain conservative about the post-holidays outlook.”

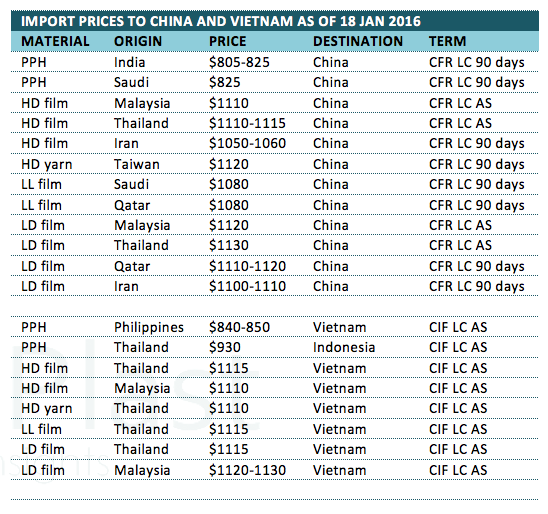

In the import market, most overseas PP suppliers have yet to open the new offers for this week. Meanwhile, a Thai producer has adjusted their PE prices down $10-20/t compared to last week to reach $1110/t for HDPE film and $1130/t for LDPE film, CFR China, LC AS term. A trader in Shanghai added, “Some buyers are taking position by purchasing cargoes to arrive after Chinese

New Year. We don’t expect to see this trend to be long lasting, hence we prefer to be cautious.”

In Southeast Asia market, several PE makers in the region have stepped back on their PE offers after ethylene costs in Asia plunged $80/t late last week. However, buyers remained wary about the outlook in the near term given volatile energy market and anticipation about a slowing down in demand as the Chinese New Year is near. A trader received Malaysian HDPE film and LDPE film with $20/t lower compared to initial offers last week said, “We have yet to decide on making fresh purchases as we are feeling very uncertain about the market outlook in the coming days. Local buyers are demanding for lower prices and we plans to wait on the sideline to avoid loses.” With sanctions imposed on Iran were lifted late last week; players are expecting an increasing number of Iranian cargoes to arrive to Asia in the coming months.

In the Vietnam PP market, there are very few suppliers have open new offers, however, buyers are generally showing stiff resistance towards prices at the higher range. In fact, a Philippines producer has attuned their offers down $20/t compared to last week to reach $850/t CIF Vietnam, LC AS term. A converter said, “We placed bid at $820/t with the same term but was not accepted. The supplier is only willing to reduce $10/t for serious deal. We are not in rush to make additional purchases as we already have sufficient material for our production.”

Kindly visit www.commoplast.com for detailed daily prices in China and Southeast Asia market, or contact us at commoplastinfo@gmail.com for assistance.