Asia Daily PP PE Report 19 Jan 2016

Asia Daily PP PE Report 19 Jan 2016

In China, futures prices on Dalian Commodity Exchange for May delivery continue to climb sharply today with PP futures advance CNY204/t ($31/t) while LLPDE futures leap CNY345/t ($52/t). Contract number 1605 settled at CNY5883/t ($765/t without VAT) for PP and at CNY8155/t ($1060/t without VAT) for LLDPE.

Physical spot offers in local market for both PP and PE also gain support from the futures trade by having CNY50/t ($8/t) increase compared to yesterday. In addition, sentiment and actual trading activities are also seeing improvement with traders reported a satisfactory number of deals concluded today. A trader in Xiamen said, “Local buyers are making the last round of pre-holiday replenishment with the encouragement from firming futures market. We expect this trend to sustain throughout this week and might fade by next week as Chinese New Year is drawing near.”

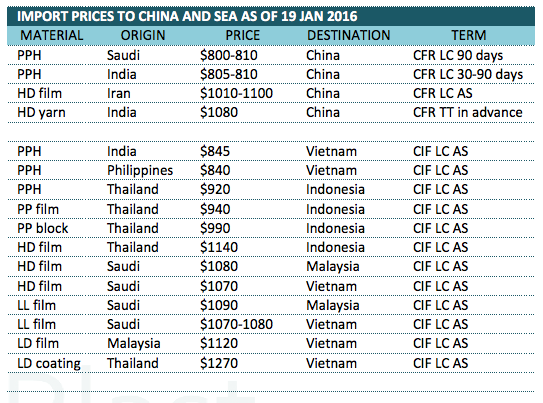

Demand in the import market is apparently not as resilient as the domestic ground with PP offers seeing little changes while PE offers continue to receive minor discount. “Our PP suppliers are maintaining their offers very firm but we see better deals in the local market these days. We don’t expect any drastic movement in the import offer for the remaining of the week, however, we prefer to be conservative about the market outlook after Chinese New Year.”

In Southeast Asia market, more overseas producers started to announce new offer for February shipment. A major Middle East producer revealed new PE prices with $20-30/t reduction from last month’s initial offers to reach $1070/t for HDPE film and $1070-1080/t for LLDPE film, CIF term. Buyers started to submit their bid prices for this cargoes with one Vietnamese buyer commented, “We are quite concern about the shipping time of these cargoes, hence we placed bid for additional $50/t discount on deal. There are number of crackers will shutdown during Feb-Apr 2016 period for maintenance and we hope this will support the PE market. At the meantime, we are also trying to gauge the state of demand in China market. ” Producers within the region reportedly conclude deal for their PE cargoes with additional discounts after adjusted their offers down $10-25/t at the beginning of the week.

The PP market remains relatively stable today with sellers are very firm on their prices. An Indonesian converter received new offer for Thailand homo-PP at $920/t CIF, LC AS term said, “The new price is unchanged from last week and we feel it is a little not competitive, especially when the Indonesian Rupiah has depreciated recently. We prefer to source from local market for now and demand for our end product is regular.” Another buyer in Vietnam purchased Philippines homo-PP after obtained $10/t discount on the price commented, “We purchased 8 containers of this material for our production after Chinese New Year. We are refraining from making large purchases as we are not confident about the post-holiday market outlook.”

Kindly visit www.commoplast.com for detailed daily prices in China and Southeast Asia market, or contact us atcommoplastinfo@gmail.com for assistance.