Asia Daily PP PE Report 29 Dec 2015

Asia Daily PP PE Report 29 Dec 2015

CommoPlast

In China, May futures prices on Dalian Commodity Exchange concluded at CNY18/t ($3/t) higher for PP today at CNY5755/t ($759/t without VAT) and CNY65/t ($10/t) higher for LLDPE at CNY7805/t ($1029/t without VAT).

Physical spot offers for PP and PE in domestic market also firm up CNY50-100/t ($8-15/t) compared to yesterday and demand for LLDPE film grade remains healthy, according to market sources. A trader in Ningbo commented, “Good demand for LLDPE film in Northern China has drawn most of the cargoes to that area causing some tightness in other regions. We see buyers are still buying on need basis and in general, demand for PE is still better than PP.”

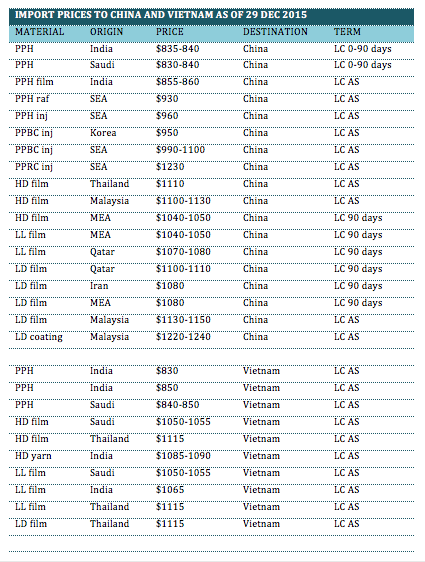

In the import market, offer for Qatar LLDPE film and LDPE film cargoes are reported at $20/t increased from last week at $1070-1080/t and $1100/t respectively. The continuous increase in local LLDPE film price in the past week has resulted in a CNY360/t ($55/t) gap between local material and import cargoes, which encourage overseas suppliers to be firm on their prices. A Southeast Asian producer said, “We have sold about 2000 tons of LDPE film cargoes at $1130-1150/t and HDPE film cargoes at $1100-1130/t, CFR China. Buyers are replenishing in small quantity and we think that it is difficult for price to go up in the near term.”

In Vietnam, local trading activities are reported to show some improvements as buyers are restocking amidst firmer energy and feedstocks costs in the past few days. A trader increased their locally-held LLDPE film and HDPE film cargoes by VND500,000-700,000/t ($22-31/t) compared to last week said, “Our customers are more willing to accept the new prices now and we managed to sell quite well these couple of days. We think that the market condition will improve further after Chinese New Year.”

In the import market, another major Saudi Arabia maker has also announced Jan shipment prices with $100/t drop compared to last month for HDPE film and LLDPE film to reach $1050/t and $70/t lower for homo-PP at $840/t, CIF Vietnam, LC AS term. Sources close to this company informed that there were some technical glitches at the PP plant, which forced the company to extend its off-line duration after a 50 days maintenance shutdown in mid-Oct 2015. The company has also deferred the restart of the LLDPE line with no definite restart date being specified.

Besides, traders are offering Indian homo-PP with $20/t increased compared to last week to reach $850/t CIF Vietnam, LC AS term. A buyer commented, “We are seeking to replenish a small quantity of homo-PP, but we are not ready to accept the $850/t level at the moment. We prefer to monitor the market movement first before decide on our purchases as crude oil soften again today.”

*Please note that CommoPlast will not have Daily report on 31 Dec and 1 Jan. Thank you for your support.

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.