Vietnamese buyers: Would there be re-export LLDPE from China?

Vietnamese buyers: Would there be re-export LLDPE from China?

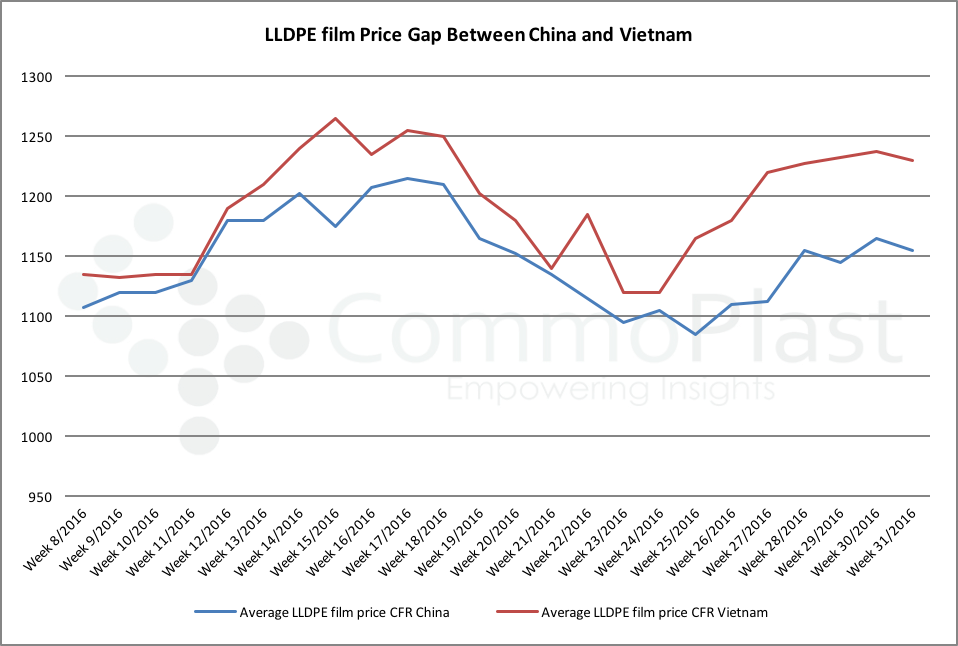

This week, several Middle Eastern producers have announced fresh prices for August delivery cargoes to both China and Vietnam markets, however, at opposite direction. Initial LLDPE film offers to Vietnam indicate some $30-60/ton hike compared to last month while to China mostly reduce $10/ton, making the price gap between two markets from certain producer reach $100/ton – a favorable aperture for re-exporting activities that unnerved many Vietnamese buyers.

Data from CommoPlast showed that on an average, import LLDPE film to China is currently traded at $75/ton below that in Vietnam. However, traders in this country are not planning to re-divert their cargoes to other market for a common reason – there is not enough material available.

A Shanghai based trader commented, “We have some Iranian LLDPE film cargoes on hand however buyers are not showing interest. Regular cargoes from Saudi is really limited, hence even with attractive margins, we couldn’t find allocation to re-export. Besides, we expect demand in China to pick up in the near term as the peak seasonal demand for agriculture film sector is just around the corner.”

Vietnam market has been suffering from deficient LLDPE film supply for an extended period of time, and at the moment, it appears that this condition might not ebb in the near term. Looking at the medium term, international producers might divert their cargoes to Asia amid uncertain Turkey outlook, which might help in easing supply tightness in the country.