Import homo-PP to China and Vietnam traded on the same par

Import homo-PP to China and Vietnam traded on the same par

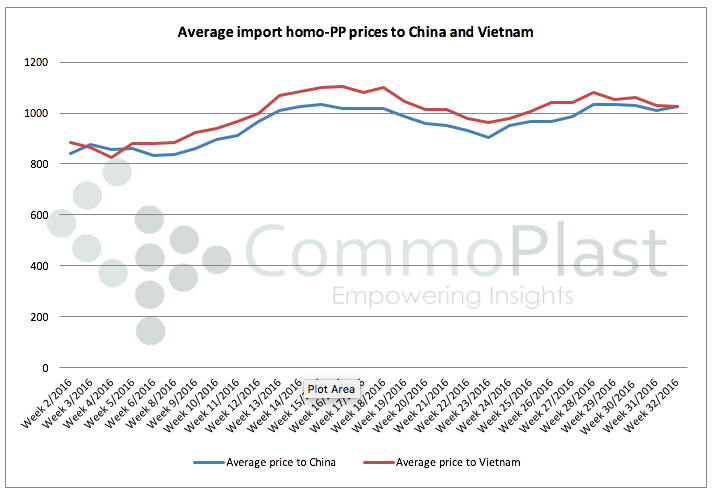

As demand for homo-PP in Vietnam falter on improved domestic supply condition and diminishing buyer confidence after energy market fell to three months low, international sellers decided to cut offers to entice buying appetite. On contrary, healthy demand in domestic market alongside with strong futures trading is keeping Chinese PP market at relatively stable trend in the past couple of weeks. This has resulted in the fact that import homo-PP to the two markets at the moment are being traded at the same par, against a usual gap of $45/ton on an average, according to CommoPlast data.

Players are speculating about a necessary correction that would bring the market back to order, in which two scenarios are widely discussed: either import homo-PP to Vietnam must rebound from the current levels or prices in China must reduce further to suit the situation.

Talking to a Chinese trader, the source said, “We are not expecting PP prices in China to move south anytime this week, especially prices at the lower end of the overall price range, given relatively satisfactory demand in local ground. We see buyers are still looking for regular homo-PP yarn grades, and this together with strong futures market would provide some support to the market in the immediate term. However, medium term outlook remain cloudy to us.”

Vietnamese buyers when discussing about this matter, expressed an interesting opinion, citing loosening domestic supply amid traditional slow season might keep the market on the stable to soft trend in the coming weeks. A market source informed, “We are making small purchases at the current prices though we think market still has room for some small discounts. For this, the balance between China and Vietnam market might take a short while to come back to normal.”