Ethylene costs reached four months high, PE market trails behind

Ethylene costs reached four months high, PE market trails behind

Ethylene costs reached four months high, PE market trails behind

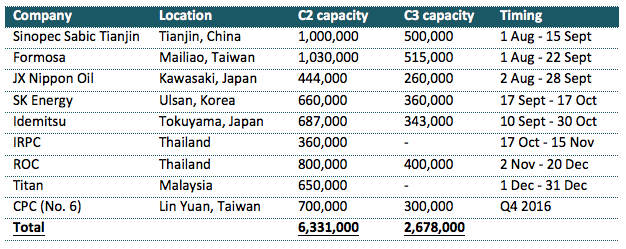

Ethylene costs have been following the up-trend since early August 2016 as supply tightened on heavy scheduled maintenance shutdown in Fareast Asia region. Indeed, in August, three major producers included Sinopec Sabic Tianjin, Formosa and JX Nippon overhaul their naphtha crackers, which resulted in an estimated production loss of 338,000 tons of ethylene. Detailed of the shutdown are shown in the following table.

Today, ethylene price based on CFR Northeast Asia term has reached the highest levels since the third week of April this year, touching $1200/ton mark. However, the downstream PE market has yet to inherit the support and still struggle to find a way north. CommoPlast data shows that on the average point, import LLDPE film to China this week stand at near to $1180/ton, LDPE film at $1160/ton and HDPE film at $1125/ton which is well below the ethylene costs at the moment. Even in local China market, where the sentiment has been bullish due to limited supply for LDPE and LLDPE film, non-integrated producers might also having negative margins at the current market levels.

Players are expecting a brighter outlook for PE market in September due to the traditional high demand season, and low inventory on hand might encourage converters to replenish cargoes ahead of the National Day holidays. Would that be sufficient to push PE prices up enough to cover the costs, many are not so optimistic.