Planned shutdown keeps Asia PP market sentiment firm

Planned shutdown keeps Asia PP market sentiment firm

The Asian PP market was facing a serious lethargic demand condition earlier this month in the absence of Chinese buyers and weakening propylene costs. However, the situation has technically reversed this week as major overseas producers announced planned shutdown during November, which is expected to keep supply in check.

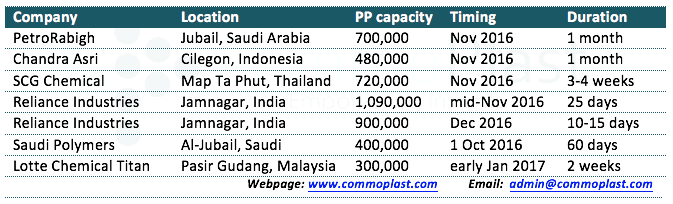

List of plants having shutdown is shown in the following table:

Buying activities improve visibly in China and in fact, import homo-PP at below the $1000/ton threshold has disappeared. Many buyers reported to have accept Middle Eastern cargoes at $1020/ton CFR China, LC 0-90 days term, yet material is very limited. A trader lifted offers by $10/ton to $1020/ton said, “Our customers did not accept our latest prices earlier this week, yet today we manage to sell very well. We have yet to see the impact of falling propylene costs on the downstream PP market, however, we think the concern over the state of supply in November due to several major shutdowns has temporary overshadowed other factors.” The source also did not expect large-scale price reduction even if propylene costs weaken further.

In Southeast Asia, buying sentiment starts showing some improvement though buyers are not very aggressive in scouting for cargoes. A Vietnamese buyer purchase Saudi Arabia homo-PP at $1020/ton CIF, LC AS term commented, “Market might continue to firm up given healthy demand in China. We received very limited number of new offers from overseas suppliers this week, mostly at $10/ton higher. The shutdowns in November might also create some support on the general sentiment.”

In Indonesia, several buyers have expressed their intention to replenish material ahead of the shutdown at Chandra Asri’s PP plant this coming month. A converter purchased some cargoes informed, “Overseas suppliers are lifting their offers beyond our acceptance levels, therefore we source material from local market. We are quite concern with the upcoming shutdown, and for this, we have stocked up material till end of November.”

Most players are not expecting any price reduction in the near term despite propylene costs based on FOB Korea term plunged $45/ton yesterday. Suppliers on the other hand are expected to hold firm stance on their cargoes to maximize profit margins. Yet, continued falling upstream costs might limit the extent of price increment, sources said.