Is China's PP and PE market due for correction?

Is China's PP and PE market due for correction?

Opinions regarding this issue at the moment are still divided.

However, one thing clear is that the futures market is now undergoing correction and whether this will affect spot prices or not, buyers are very cautious about making fresh purchases. Compared to last Friday, January delivery contract for PP has slumped CNY605/ton ($88/ton) and LLDPE futures fell CNY620/ton ($90/ton) this morning session.

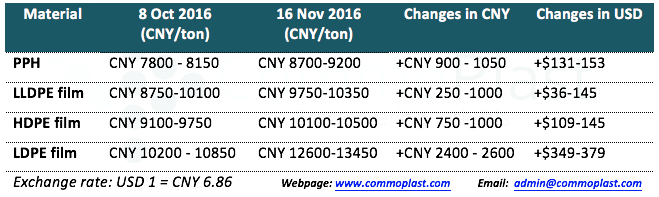

Domestic PP and PE prices in China have been escalating since players returned from the National Day holidays in early October on healthy demand and limited supply. The following table compared local prices on 8 October 2016 and this week’s.

Local traders are offering small discounts to entice buying interest, however the pace of price reduction has been small. Buyers, who were expecting larger price cut, in line with the plunging futures trade, continue to adopt wait and see stance. A trader commented, “We are cutting our offers by CNY150-200/ton ($22-29/ton) today, minimizing our own profit margins as domestic producers are not responding to weaker futures trade yet. Even with such discount, buyers are simply not interested to replenish material.” The source added that market might persist on the softening trend in the near term if demand condition does not improve.

Another trader added, “We are expecting more of an adjustment than a correction. Local supply is still tight while international availability is not ample due to maintenance shutdowns. This would prevent spot prices from large reduction.”

Several international traders have also expressed their viewpoint, mostly seeing weak fundamental support for a continued firming trend. A market source said, “We think the preparation for the festive season is completed. And with the Chinese Yuan at eight years low, import cargoes might be hit.” Import homo-PP to China has been traded above of that in Southeast Asia for at least three weeks now.

While uncertainties are there to stay, market appears to be loosing out on supportive factors for a stable to firm trend. The tug of war between limited supply and weak buying interest shall determine the likely market direction in the near term.