Asia Daily PP PE Report 06 Jan 2016

Asia Daily PP PE Report 06 Jan 2016

CommoPlast

In China, futures prices on Dalian Commodity Exchange turn south today with contract number 1605 for PP drop CNY77/t ($12/t) to close at CNY5773/t ($753/t without VAT), while LLDPE futures go down by CNY CNY80/t ($12/t) to settle at CNY7990/t ($1040/t without VAT).

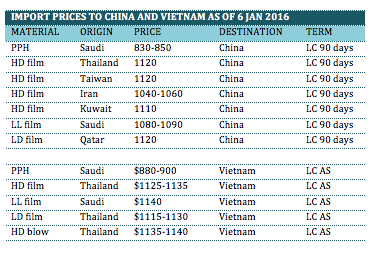

Sentiment in the local market turns sour in spite of CNY100/t ($15/t) firmer for PE on local producer’s price list. A trader in Xiamen elaborated, “We only managed to sold some LLDPE film cargoes today since buyers are slowing down on making fresh purchases amid weakening local currency. We think this factor might distract customers from the import market in the near term.” Another trader in Shanghai reported to have sold Thailand and Taiwanese HDPE film at $1120/t CFR China, LC 90 days term said, “The firming trend in local market started to loose momentum and we expect more of stable trend to take place in the coming day.”

In Vietnam, trading activities continue to show improvement today, especially in the local market, according to players. Overseas PP suppliers have yet to announce new offer, however higher prices offered by local traders appear to have been accepted by buyers. Several converters reported to have purchased Vietnamese homo-PP at VND23,500,000/t ($950/t without VAT) FD Vietnam, including VAT, cash term. A distributor commented, “Trading activities in local market have improved compared to the past couple of weeks but we remain conservative

about the outlook in the coming month. Recently, we focus more on selling in local market instead of exporting to Indonesia due to weaker rupiah and more attractive local material have attracted Indonesian buyers away from the import market.”

In the PE market, overseas suppliers are claiming to have limited supply with very few number of import offer reported today. A major Thailand produced firmed up their PE prices to $1135/t for HDPE and $1130/t for LDPE in the morning but quickly stepped back on their LDPE offer in the afternoon. Another major Southeast Asian producer reported, “We have sold 200 tons of HDPE blow moulding in Vietnam today at the level $1135/t CIF, LC AS term. Our customers were reluctant at first but they accepted the price later as we have very limited allocation. We have yet to announce new offer for other grades.”

Meanwhile, another trader active in selling to European market informed that their Thai supplier implemented a $90/t hike on HDPE price compared to last month. The source added, “Demand in European market in still good while our Thai suppliers seem not having much material these days. We think that the PE market might be able to hold firm in the near term.”

For further information, kindly contact our market analysts at commoplastinfo@gmail.com.