Tight propylene forces Chinese PP maker reduce operation rate

Tight propylene forces Chinese PP maker reduce operation rate

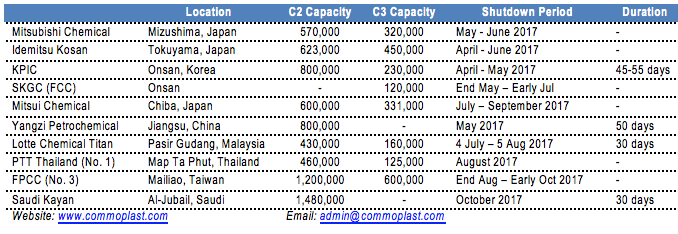

Propylene costs in Asia has been following the stable to firmer trend over the past two weeks on tightening supply stemming from several major shutdown in the region. Propylene based on CFR China term topped about $30/ton from mid of June, to reach $881/ton on Tuesday.

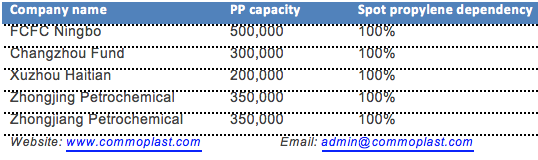

Though the firming trend was initially expected to provide solid support to the downstream PP market, players were rather disappointed with the result as several international suppliers continue cutting prices to attract buying interest. This has had non-integrated producers in China squeezed and couple have decided to lower operating rate.

Market players reported that both Zhongjing and Zhongjian Petrochemical have cut run rate this week to protect profit margins, yet players are not seeing significant impact on the supply. A market source said, “The woven bag sector is in off-peak season, hence converters are not showing eager to make replenishment in spite of strong upstream costs and risk of tightening PP supply. We think market might not witness any drastic swing in the near term.”

On an average, domestic homo-PP yarn in China stands at about CNY7695/ton ($964/ton without VAT), EXW China, cash term – which is below theoretical costs based on current propylene prices. “We think the up-side of propylene market is rather limited given weak PP demand at the moment. In order for non-integrated to cover the costs at the present PP level, propylene would have to be around $800/ton.”