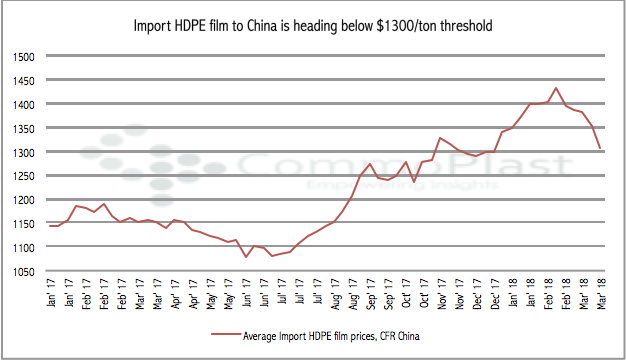

Import HDPE film to China slipped below the $1300/ton threshold

Import HDPE film to China slipped below the $1300/ton threshold

Import HDPE film to China has been slithered down the slope after hitting the peak on the second week of February 2018, however, took deeper dive in late March. On an average, import HDPE film to China fell about $125/ton, to be traded in the range $1270-1350/ton CFR China, LC 0-90 days term as of 28 March 2018, CommoPlast data showed.

More producers are cutting import offers to China this week, from which more prices are moving below the $1300/ton threshold. Market sources are not seeing this trend reversed in the near term given the fact that supply is recovering while demand is not supportive.

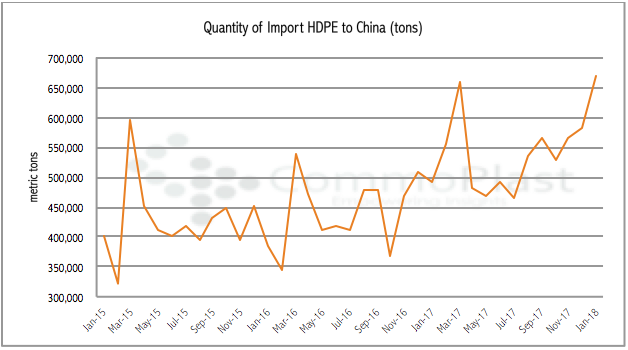

The continuous uptrend in import HDPE market since mid-2017 as a result of buyers searching replacements after the ban on plastic waste imports rocked recycle industry has attracted many overseas suppliers to divert cargoes to China. Import arrival to China in January hit multi-year high levels, surging 26.2% from October 2017 to 667,485 tons.

The increased import arrival coupled with a drastic surge in domestic inventories after the long Lunar New Year holiday released the market from the persistent tight supply condition; especially post-holiday demand is much weaker than expected. In the meantime, it also weighs on the market sentiment.

A trader offers Kuwait HDPE film at $1290/ton CFR China, LC AS term, a $10/ton lower than official price list said, “Buyers are very cautious about buying import given competitive local cargoes. In spite of stronger upstream and energy markets, we find it difficult to attract sufficient buying interest.”

Most other Middle Eastern cargoes are offered in the range $1300-1345/ton CFR China, LC AS term. “However, we do expect discounts on deals. The market is just not in the state of accepting any prices,” another trader informed.

Total inventories at major domestic producers’ warehouses constantly reducing over the past three trading sessions, which promises a brighter outlook in the near term. At the meantime, it is important to take note of the long weekend holiday next week, which might push local inventories to near the 1 million tons once market resumes working on the second week of April.