Asia Daily PP PE Report 14 Jan 2016

Asia Daily PP PE Report 14 Jan 2016

In China, May futures contract on Dalian Commodity Exchange settle today with CNY101/t ($15/t) higher for PP at CNY5632/t ($730/t without VAT) and CNY5/t higher for LLDPE futures to reach CNY7780/t ($1010/t without VAT).

Physical spot offers for both PP and PE in domestic market remained unchanged from yesterday, however, there is a pick up in demand concentrating mainly on homo-PP and LLDPE film grades. A trader in Ningbo reported, “Local converters and re-sellers are making pre-Chinese New Year replenishment and the number of deal we could close today is satisfactory. We think this trend might sustain till next week but we remain cautious about the outlook beyond that.” “We managed to sell more homo-PP to local buyers today but we think this is very much like a cycle whenever market see big hike in futures prices. Buyers apparently are not taking large quantity, hence we expect local inventory to escalate after the long Chinese New Year holidays,” a source in Shanghai added.

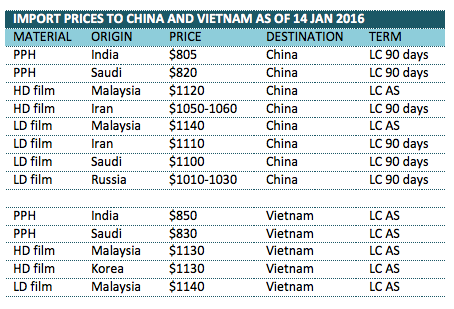

In the import market, an Indian producer announced new offer for homo-PP to China with $25/t lower compared to last week at $805/t CFR China, LC 90 days term.

Players in the PE market see better demand for local cargoes, yet buying interest for import parcels is rather lethargic. A trader offers Iranian HDPE film at $1050-1060/t and LDPE film at $1110/t CFR China LC 90 days term said, “We have already stepped back on out offers compared to last week in an attempt to stimulate buying interest, but our customers are still bidding for $10-20/t lower.”

In Southeast Asia market, a major regional producer has announced Feb price for PE cargoes at stable to $10/t increase compared to last month. The latest offer from the producer stands at $1140/t for LDPE film and $1120-1130/t for HDPE film CIF SEA, LC AS term. Source from the producer commented, “We did not give mass offer for PP cargoes this month as we focus on regular customers only. We found it very difficult to conclude deal for HDPE film cargoes these days.”

In the upstream market, ethylene monomers based on CFR Southeast Asia term plunged $85/t toward the end of the day to close at $1005/t in spite of another unexpected shutdown at Chandra Asri Indonesia’s naphtha cracker. Buyers were caught with surprise and many expressed their renewed concern about the market outlook in the near term. A buyer said, “Our Malaysian supplier informed that they have very limited LDPE film cargoes but we are not sure whether to make fresh purchases at the moment. Meanwhile, our Korean suppliers are very aggressive with their HDPE parcels. We are really not optimistic about the outlook in the coming week.” Another regional trader added, “There are too much of confusion in the market at the moment, hence we are not in hurry to commit volume trade.”

In the PP market, overseas suppliers have adjusted down their homo-PP offers to Vietnam $20/t compared to beginning of the week. A converter received offer for Saudi’s homo-PP at $830/t CIF term said, “We did not proceed with purchases even after the price reduction as we would like to monitor further movement before making additional purchases. Demand for our end product is regular.”

Kindly visit www.commoplast.com for detailed daily prices in China and Southeast Asia market, or contact us atcommoplastinfo@gmail.com for assistance.