Falling butadiene and styrene monomer costs pressure Asian ABS market

Falling butadiene and styrene monomer costs pressure Asian ABS market

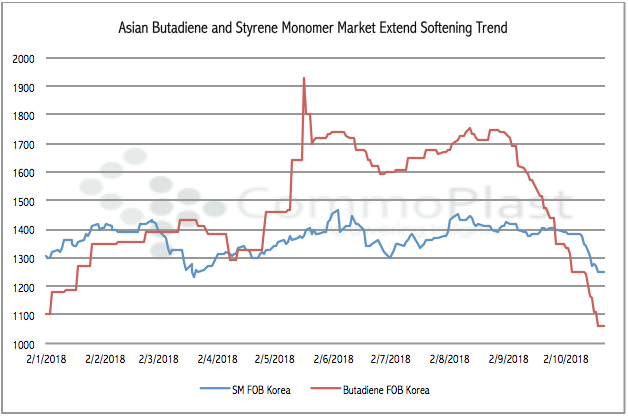

The Asian butadiene market has hit a fresh low this year after weeks of steep reduction as a result of weak demand across the region. The development, in combined with the softening trend in the styrene monomer cost is now putting tremendous downward pressure on the ABS market.

In fact, butadiene based on FOB Korea term has shredded $190/ton since the beginning of October and when compared to the last peak during late August, the market has lost $690/ton to $1060/ton as on 22 October 2018. Meanwhile, styrene monomer (SM) based on FOB South Korea has also plunged approximately $130/ton compared to the beginning of October.

Industry sources are pointing to the fact that US-China trade war has affected market sentiment in both upstream SM and butadiene and the downstream market, and that the outlook remains uncertain in the near term.

The deep plunge in SM and butadiene costs has been dragging the ABS prices lower over the past couple of weeks. At the time this report is published, import ABS originated from Fareast Asia is mostly offered below the $1800/ton threshold, ranging $1720-1780/ton, CIF Southeast Asia, LC AS term.

“There is still room for further reduction. The ABS market is very likely to breach below the $1600/ton mark soon,” a regional buyer said. The source receive offers for South Korean ABS at $1720/ton CIF Vietnam, LC AS

Meanwhile, an Indonesian trader informed of the stable trading condition in the local ground for now but expressed the concern that sentiment might start to deteriorate soon if the upstream market extends the falling trend. “That’s why we have not made any replenishment. The theoretical costs at the current monomer prices point to much lower than the existing offers levels,” a trader received offers for South Korean ABS at $1750-1780/ton CIF Indonesia, commented.

The downward pressure on the ABS market mostly comes from the costs side as a number of converters are still seeing stable end product orders for the year-end season. “In the meantime, we plan to wait for more discount to emerge. The import ABS market has been traded at high levels for a very long time,” a Vietnamese household product manufacturer added.